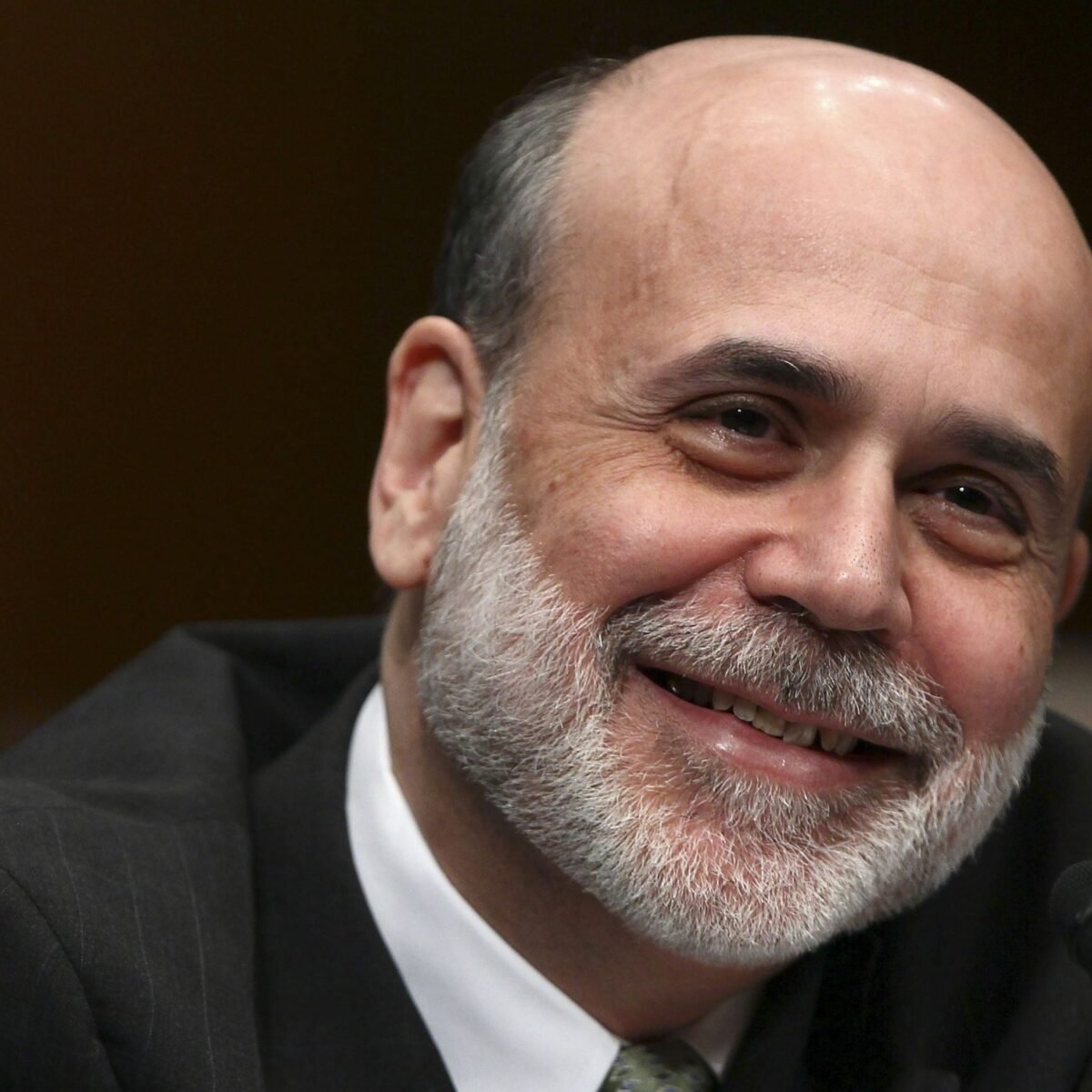

Who is Ben Bernanke?

Ben Bernanke is a renowned American economist who served as the Chairman of the Federal Reserve from 2006 to 2014. He played a crucial role in stabilizing the U.S. economy during the 2008 financial crisis. His policies and decisions significantly shaped modern monetary policy, making him one of the most influential central bankers in history.

Early Life and Education

Born on December 13, 1953, in Augusta, Georgia, Ben Bernanke grew up in Dillon, South Carolina. From a young age, he displayed an exceptional aptitude for mathematics and economics. His academic journey took him to Harvard University, where he graduated summa cum laude with a degree in economics. He then pursued a Ph.D. in economics from the Massachusetts Institute of Technology (MIT), specializing in macroeconomics and monetary policy.

Academic Career and Economic Contributions

Before joining the Federal Reserve, Bernanke was a respected professor and researcher. He taught at Stanford University and later at Princeton University, where he served as the chair of the economics department. His research focused on economic downturns, particularly the Great Depression. His work emphasized the role of financial institutions in economic stability, insights that later guided his policy decisions.

One of his most famous contributions to economic thought is the “Bernanke Doctrine,” which outlines strategies for combating deflation. His belief in proactive monetary policy interventions laid the foundation for his approach as Federal Reserve Chairman.

Appointment as Federal Reserve Chairman

In 2006, President George W. Bush appointed Bernanke as the Chairman of the Federal Reserve, succeeding Alan Greenspan. At the time, the U.S. economy appeared stable, and Bernanke initially focused on continuing Greenspan’s policies. However, just two years into his tenure, the global financial crisis erupted, posing unprecedented challenges.

Handling the 2008 Financial Crisis

The 2008 financial crisis was one of the most severe economic downturns in modern history. It was triggered by the collapse of Lehman Brothers, a major investment bank, which led to panic in financial markets. As the crisis unfolded, Bernanke played a central role in implementing emergency measures to prevent a total economic meltdown.

1. Lowering Interest Rates

To stimulate economic growth, Bernanke rapidly lowered interest rates to near-zero levels. This made borrowing cheaper, encouraging businesses and consumers to spend and invest, thereby preventing further economic contraction.

2. Quantitative Easing (QE)

One of Bernanke’s most significant policies was quantitative easing (QE), an unconventional monetary policy tool. Under QE, the Federal Reserve purchased long-term securities, injecting liquidity into financial markets. This helped stabilize stock markets and restored investor confidence.

3. Bailouts and Financial Institution Rescues

Bernanke supported government interventions to rescue major financial institutions deemed “too big to fail.” The bailout of insurance giant AIG and the Troubled Asset Relief Program (TARP) provided much-needed capital to struggling banks, preventing a collapse of the financial system.

4. Stress Tests and Banking Reforms

To restore public trust, Bernanke introduced rigorous stress tests for banks. These tests assessed whether banks had enough capital to withstand economic shocks, ensuring they were financially stable before receiving federal support.

Controversies and Criticisms

While many credit Bernanke with preventing a deeper economic depression, his policies were not without controversy. Some critics argued that his aggressive monetary policies fueled income inequality by benefiting Wall Street more than Main Street. Others believed that quantitative easing increased financial risks, creating asset bubbles in the stock market and real estate.

Additionally, the bailouts of large banks sparked public outrage, as many viewed them as rewarding reckless financial behavior. However, Bernanke defended these actions, asserting that they were necessary to stabilize the economy and prevent mass unemployment.

Post-Fed Career and Continued Influence

After stepping down as Fed Chairman in 2014, Bernanke joined the Brookings Institution, where he continues to provide insights on monetary policy and economic stability. He has also authored several books explaining his policies and experiences during the financial crisis, including The Courage to Act: A Memoir of a Crisis and Its Aftermath.

Nobel Prize in Economic Sciences

In 2022, Bernanke, along with Douglas Diamond and Philip Dybvig, won the Nobel Prize in Economic Sciences for research on banking and financial crises. Their work provided a deeper understanding of how financial institutions function and how their failures can lead to broader economic instability.

Bernanke’s Lasting Legacy

Bernanke’s tenure at the Federal Reserve set a new precedent for crisis management. His use of unconventional tools like quantitative easing and aggressive interest rate cuts has influenced central banks worldwide. The policies he implemented during the crisis are now considered part of the standard playbook for handling financial downturns.

Impact on Future Monetary Policy

Many of Bernanke’s strategies were later used by the Federal Reserve during the COVID-19 pandemic to mitigate economic fallout. His approach demonstrated that central banks could take bold actions to stabilize economies during crises, reinforcing the importance of proactive monetary policy.

Critics vs. Supporters

While some economists argue that Bernanke’s policies contributed to long-term financial instability, others praise him for preventing a second Great Depression. His ability to navigate the complexities of the 2008 crisis has cemented his reputation as one of the most influential central bankers in history.

Conclusion

Ben Bernanke’s leadership during the 2008 financial crisis showcased his deep understanding of economic policy and crisis management. His decisions reshaped global finance, setting new standards for central banking interventions. Whether viewed as a hero or a controversial figure, there is no denying that his impact on economic policy and financial stability is profound and enduring.

Also Read – Paul Krugman: Economic Theories, Insights & Global Impact