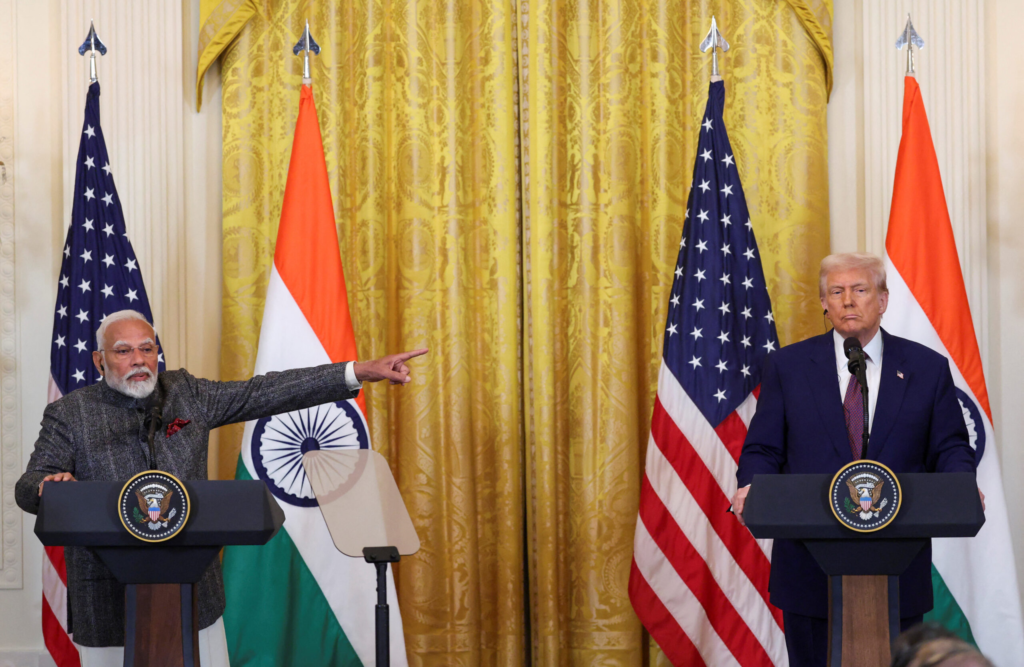

The ongoing tariff war between India and the United States has become a major issue in global trade. With both countries imposing and revising tariffs on key goods and services, the conflict is growing. The central question is: How will India fare in this tariff war with the US? Let’s explore the background, current situation, and future outlook.

What Started the Tariff War?

India and the US have enjoyed a generally positive trade relationship for decades. However, tensions began rising in recent years due to differences in trade policies, market access, and tariffs. The United States, under the Trump administration, withdrew India’s Generalized System of Preferences (GSP) status in 2019, which had allowed duty-free exports on over 3,000 Indian products.

India responded by imposing retaliatory tariffs on 28 US goods including almonds, apples, and walnuts. Since then, the trade tension has evolved into a more strategic tariff war, impacting sectors like steel, electronics, pharmaceuticals, agriculture, and technology.

The Latest Developments in 2025

In 2025, the Biden administration has signaled a firmer stance on global trade practices, which includes pressuring India to reduce its import barriers. In response, India has started defending its trade policies, citing domestic interests, economic security, and Make-in-India strategies.

As of now:

- The US is considering higher tariffs on certain Indian steel and pharmaceutical products.

- India is preparing a counter plan, potentially increasing tariffs on US agricultural and tech imports.

- Both nations are exploring trade talks but with no major breakthrough.

The World Trade Organization (WTO) has also become involved, as both sides have taken complaints to the global trade body. India argues that the US is violating fair trade norms, while the US accuses India of unfair protectionism.

Key Sectors Affected by the Tariff War

1. Agriculture:

US farmers have been hit by India’s tariffs on almonds, apples, and other nuts. These are major export products for states like California and Washington. Meanwhile, Indian consumers are now paying higher prices for these items.

2. Steel and Aluminum:

India exports a significant amount of steel to the US. New US tariffs on these goods would hurt Indian manufacturers and reduce their global competitiveness.

3. Pharmaceuticals:

India’s pharma exports to the US are worth billions of dollars. If the US raises tariffs or tightens regulations, it could damage India’s pharma industry, which is already facing compliance issues.

4. Tech Products:

India has recently increased import duties on mobile phones, electronics, and other tech goods to promote domestic manufacturing. The US, home to tech giants like Apple and Google, sees this as a barrier to market access.

India’s Strengths in This Trade Conflict

India is not entirely at a disadvantage. Here’s why:

1. Strategic Global Partnerships:

India has been strengthening its ties with the European Union, the UK, Australia, and Southeast Asian countries to reduce dependency on the US market. These agreements can help offset any trade loss due to US tariffs.

2. Growing Domestic Market:

India’s large population and expanding middle class offer an enormous internal market. Many companies are now focusing on domestic consumption to stay afloat even with reduced exports.

3. Policy Reforms:

India has introduced multiple reforms such as Production-Linked Incentive (PLI) schemes, tax benefits for manufacturers, and ease-of-doing-business initiatives to make itself more globally competitive.

4. WTO Support:

India is gaining support from other developing countries in its complaint against the US at the WTO. This may lead to greater pressure on the US to ease its tariff stance.

US Concerns and Leverage

From the US side, the focus is on:

- Protecting American jobs and industries.

- Ensuring fair access to Indian markets.

- Using tariffs as a tool to pressure India into signing a broader trade agreement.

The US has significant leverage because India depends heavily on American technologies, defense equipment, and education services. Any restriction in these areas could put pressure on Indian industries and the student community.

Economic Impact on India

India’s exports to the US account for over $75 billion annually, while imports are around $40 billion. If tariffs rise on either side, India could lose billions in export revenue, leading to:

- Job losses in manufacturing and agriculture.

- Higher costs for consumers.

- Slower GDP growth, especially in the trade and industrial sectors.

However, experts believe India has the resilience to bounce back by:

- Diversifying export markets.

- Encouraging local manufacturing.

- Increasing trade with Asia-Pacific and Africa.

Is There a Path to Peace?

There is always room for diplomacy. Both countries share strategic interests in areas like defense, climate change, and technology. Trade negotiations can reopen at any time if both sides agree to compromise.

A potential mini-trade deal — focused on a few sectors like information technology, defense, and pharma — may be the first step. Additionally, India and the US can work through platforms like the Quad and G20 to resolve trade differences amicably.

Conclusion: Can India Win the Tariff War?

So, how will India fare in its tariff war with the US? The answer lies somewhere in the middle.

India is unlikely to emerge as a complete winner due to its dependence on the US market. However, it is not without options. By strengthening alliances, boosting local production, and standing firm on its policies, India can cushion the impact and use this situation as a catalyst to become more self-reliant.

In the end, a balanced approach — combining diplomacy, strategy, and domestic reform — will determine how successfully India navigates this challenging trade conflict.

To learn more about the India-US trade conflict and its impact on the global economy, visit:

- World Trade Organization – Disputes Overview

- Ministry of Commerce and Industry, India

- Office of the United States Trade Representative

These resources provide official updates and analysis on ongoing trade disputes and policies.

Also Read – Why Inflation Is Still Draining Your Wallet in 2025