The food pathogen testing market in the United States is undergoing a transformative phase, driven by rising foodborne illness concerns, stricter regulations, and groundbreaking technological advancements. With food safety becoming a top priority for consumers, regulators, and food producers, the market is poised for significant growth from 2025 to 2032. This article explores the revolutionary shifts, emerging technologies, and key trends shaping the future of the food pathogen testing industry in the USA, offering insights into its trajectory over the next decade.

The Growing Importance of Food Pathogen Testing

Foodborne illnesses remain a pressing public health challenge in the United States. According to the U.S. Food and Drug Administration (FDA), approximately 48 million Americans suffer from foodborne illnesses annually, leading to 128,000 hospitalizations and 3,000 deaths. Pathogens such as Salmonella, E. coli, and Listeria are among the leading culprits, often linked to contaminated meat, poultry, dairy, and processed foods. These alarming statistics have heightened consumer awareness and pushed food manufacturers to adopt rigorous testing protocols to ensure product safety.

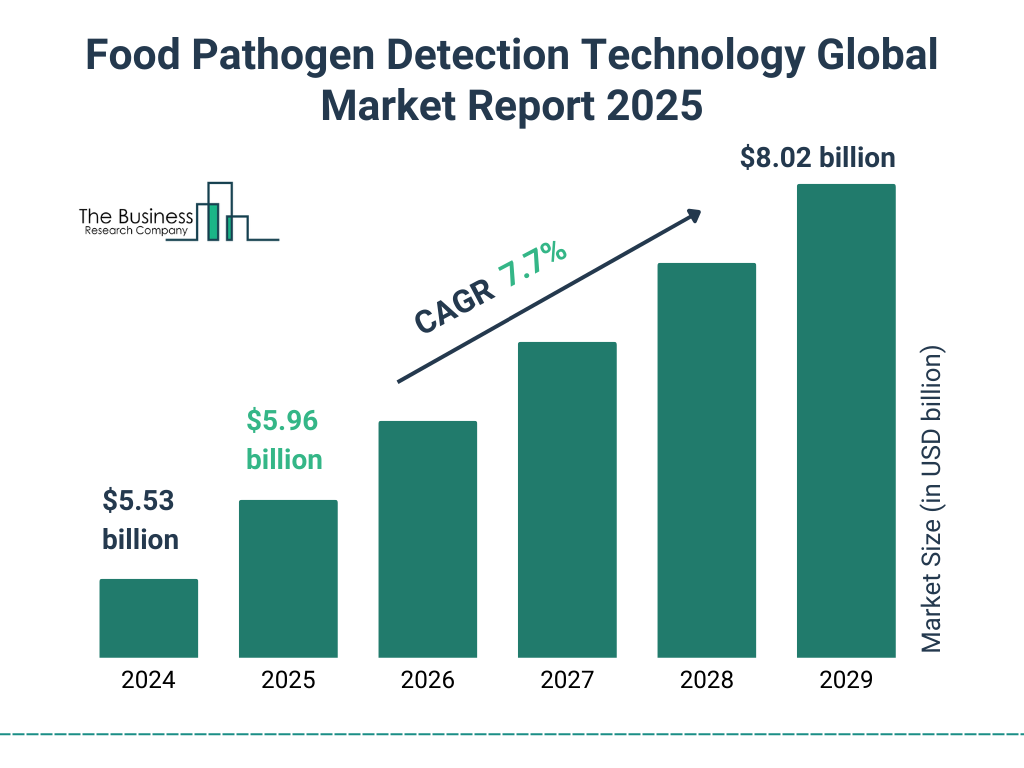

The food pathogen testing market, valued at approximately USD 4.30 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 7.06% from 2025 to 2032, potentially reaching USD 7.62 billion by the end of the forecast period. This growth is fueled by increasing demand for safe food, advancements in testing technologies, and stringent regulatory frameworks like the Food Safety Modernization Act (FSMA), which emphasizes preventive measures over reactive responses to contamination.

Key Market Drivers

Several factors are driving the expansion of the food pathogen testing market in the USA:

- Rising Foodborne Illness Outbreaks: The prevalence of foodborne diseases continues to push the demand for advanced testing solutions. For instance, Salmonella accounted for 19.3% of foodborne illness outbreaks in 2021, highlighting the need for robust detection methods. High-profile recalls, such as Tyson Foods’ recall of 8.9 billion pounds of chicken products in 2021 due to potential Listeria contamination, underscore the critical role of pathogen testing in preventing widespread health risks.

- Stringent Regulatory Standards: The FDA’s FSMA has revolutionized food safety by mandating proactive testing and traceability throughout the supply chain. This regulatory shift compels food producers to invest in advanced testing technologies to comply with strict guidelines, boosting market growth. Additionally, the U.S. Department of Agriculture (USDA) enforces rigorous standards for meat and poultry, further driving the need for pathogen testing.

- Consumer Awareness and Demand for Quality: Today’s consumers are more informed about food safety and demand transparency from food producers. This trend has prompted companies to prioritize pathogen testing to maintain brand reputation and consumer trust.

- Globalization of Food Supply Chains: The increasing import and export of food products have heightened the risk of contamination, necessitating comprehensive testing to ensure compliance with international safety standards.

Revolutionary Technologies Transforming the Market

The food pathogen testing industry is witnessing a technological revolution, with innovations enhancing the speed, accuracy, and efficiency of testing processes. Below are some of the most impactful technologies shaping the market from 2025 to 2032:

1. Polymerase Chain Reaction (PCR)-Based Testing

Polymerase Chain Reaction (PCR) technology is a cornerstone of modern food pathogen testing, accounting for a significant share of the market. PCR amplifies specific DNA sequences, enabling the detection of even minute quantities of pathogens like Salmonella and E. coli. Its high sensitivity, specificity, and rapid results make it a preferred choice for food manufacturers. In 2023, PCR-based assays dominated the market, and their adoption is expected to grow due to their ability to deliver results in less than 48 hours, allowing for quicker corrective actions.

2. Next-Generation Sequencing (NGS)

Next-generation sequencing is emerging as a game-changer in food safety testing. Unlike traditional methods, NGS offers comprehensive analysis capabilities, identifying novel pathogens and providing detailed insights into microbial contamination. Its high throughput and enhanced sensitivity make it ideal for testing complex food matrices. While still in its early stages of adoption, NGS is projected to grow at a higher CAGR than PCR, driven by its potential to revolutionize pathogen detection in the food industry.

3. Biosensors for Rapid Testing

Biosensors are gaining traction for their affordability, rapid response times, and non-destructive testing capabilities. These devices can detect pathogens, toxins, and antibiotic residues in real time, offering a significant advantage over conventional methods. In July 2023, Spectacular Labs introduced an automated pathogen testing platform that allows on-site testing, enabling food producers to identify contaminants quickly and cost-effectively. Such innovations are expected to drive the adoption of biosensors in the coming years.

4. Artificial Intelligence (AI) and Machine Learning (ML)

The integration of AI and machine learning into food safety testing is enhancing the accuracy and efficiency of pathogen detection. These technologies can analyze large datasets to identify patterns of contamination, predict potential outbreaks, and optimize testing protocols. In January 2025, the Indian Export Inspection Council announced the use of IoT-based sampling techniques, a trend that is likely to gain traction in the USA as well, further boosting the adoption of AI-driven solutions.

5. Automated Testing Platforms

Automation is streamlining food safety testing by reducing human error and increasing throughput. Companies like Neogen Corporation have introduced innovative solutions, such as the Petrifilm Bacillus cereus Count Plate, which simplifies microbial testing. Automated platforms enable food producers to handle high volumes of samples efficiently, making them a critical component of modern testing facilities.

Market Segmentation and Trends

The food pathogen testing market in the USA is segmented by pathogen type, technology, application, and testing site. Key trends include:

- Pathogen Type: Salmonella testing holds the largest market share, driven by its prevalence in foodborne illness outbreaks. However, E. coli testing is the fastest-growing segment, with a projected CAGR of 7.48% from 2025 to 2032, due to its association with severe health risks.

- Application: The meat and poultry segment dominates the market, reflecting the high risk of contamination in these products. The beverages segment is expected to grow at a CAGR of 6.86%, driven by increasing consumer demand for safe and high-quality drinks.

- Testing Site: In-house testing labs accounted for the largest market share in 2024, with a revenue of USD 1.76 billion. However, outsourcing to third-party labs is the fastest-growing segment, as food producers seek specialized expertise and cost-effective solutions.

- Regional Insights: The USA leads the North American food pathogen testing market, which is expected to reach USD 6.64 billion in 2025 and grow at a CAGR of 5.39% through 2030. The country’s dominance is attributed to its advanced infrastructure, stringent regulations, and high consumer awareness.

Competitive Landscape

The food pathogen testing market in the USA is highly competitive, with key players investing heavily in research and development to stay ahead. Leading companies include:

- SGS S.A.: A global leader in inspection and testing services, SGS is expanding its microbiological testing capabilities in the USA.

- Eurofins Scientific: Known for its comprehensive testing services, Eurofins is a major player in chemical and microbiological analysis.

- Bureau Veritas: In October 2024, Bureau Veritas expanded its food testing business, acquiring 34 laboratories across 15 countries to strengthen its global presence.

- Neogen Corporation: A pioneer in rapid testing solutions, Neogen’s innovations, such as the Petrifilm platform, are driving market growth.

- Intertek Group PLC: Intertek is leveraging advanced technologies to offer customized testing solutions to food producers.

These companies are focusing on strategic partnerships, acquisitions, and product launches to enhance their market position. For instance, in February 2020, Crystal Diagnostics received a patent for its liquid crystal technology, which enables rapid and accurate pathogen detection.

Challenges and Opportunities

Despite its growth potential, the food pathogen testing market faces challenges, including the high cost of advanced testing equipment and a lack of skilled technicians in some regions. Developing countries, in particular, struggle with inadequate infrastructure, which could limit market expansion. However, these challenges present opportunities for innovation, as companies invest in cost-effective and user-friendly solutions to address these gaps.

The rise of rapid testing technologies and the increasing adoption of automation and AI offer significant opportunities for market players. Additionally, the growing demand for processed and packaged foods, driven by urbanization and changing consumer lifestyles, is expected to fuel the need for pathogen testing, creating new avenues for growth.

The Road Ahead: 2025-2032

The food pathogen testing market in the USA is on the cusp of a transformative era, driven by technological advancements, regulatory changes, and consumer demand for safe food. As the market grows from USD 4.30 billion in 2024 to an estimated USD 7.62 billion by 2032, innovations like PCR, NGS, biosensors, and AI will play a pivotal role in shaping its future. With major players investing in cutting-edge solutions and regulatory bodies enforcing stricter standards, the industry is well-positioned to ensure safer food for all.

For more information on market trends, visit SkyQuest Technology or explore detailed reports at Fortune Business Insights. To understand the broader food safety testing landscape, check out Mordor Intelligence.

Also Read :- AI-Driven Ad Campaigns: Personalizing Content, Boosting Engagement, and Sparking Privacy Debates