In a surprising but welcome update for global markets, Apollo Global Management’s chief economist has significantly lowered the probability of a U.S. recession in 2025—from a troubling 90% to a much more manageable 30%. The key reason behind this shift? A marked improvement in trade relations between the United States and China.

The announcement is fueling optimism on Wall Street, among policymakers, and in international trade circles. The world’s two largest economies appear to be stepping back from a prolonged trade conflict that many feared would push the U.S. into a deep economic slowdown next year.

Why the Forecast Changed: U.S.-China Trade Relations Improve

Apollo’s top economist, Torsten Slok, highlighted the de-escalation of trade tension as the main driver behind the updated forecast. He explained that easing tariffs, renewed dialogue, and a potential for collaborative trade agreements between the U.S. and China have reduced the likelihood of a major economic disruption in 2025.

Slok pointed out that fewer restrictions on goods and services flowing between the countries are already improving supply chain efficiency and investor confidence. Trade data from Q2 2025 show an uptick in U.S. exports to China, along with an increase in U.S.-based companies investing in Asian markets.

Read more about U.S.-China economic relations

Recession Risk Drops: What This Means for the U.S. Economy

Earlier in the year, Apollo’s economic outlook had been far more bearish. The firm’s original 90% recession projection was based on ongoing inflation, interest rate hikes, and geopolitical instability—particularly around trade.

Now, with the U.S. Federal Reserve showing signs of slowing its rate hikes and trade headwinds fading, Slok and his team are seeing signs of stability. Lower recession risk means more businesses are likely to hire, invest, and expand, which in turn creates a positive cycle for economic growth.

The shift could also affect consumer behavior. When fears of a recession fade, consumer confidence rises, which drives more spending on homes, cars, technology, and travel.

Learn more about consumer confidence trends in 2025

Market Response: Stocks, Bonds, and Investor Sentiment React

Following the news from Apollo, major stock indexes rallied. The S&P 500 rose nearly 2% within 24 hours of the announcement, while the Nasdaq and Dow Jones also saw strong gains. Analysts say the optimism is largely driven by reduced economic uncertainty.

Bond markets also responded positively. U.S. Treasury yields dipped slightly, a sign that investors are more willing to take risks with stocks and corporate bonds. The demand for low-risk government securities generally falls when economic conditions are expected to improve.

Wall Street is now watching for additional signs of improved U.S.-China cooperation. Trade envoys from both nations are expected to meet again later this month, with key issues including semiconductor trade, tariffs on industrial goods, and agricultural exports on the agenda.

Stay updated with U.S. economic data and trends

Global Impact: Better Trade Ties Boost Worldwide Growth

The improved trade outlook between the U.S. and China doesn’t just benefit American investors. Global markets are also reacting positively. European markets saw gains, and Asian stocks—especially those in export-heavy countries like South Korea and Japan—experienced a strong rally.

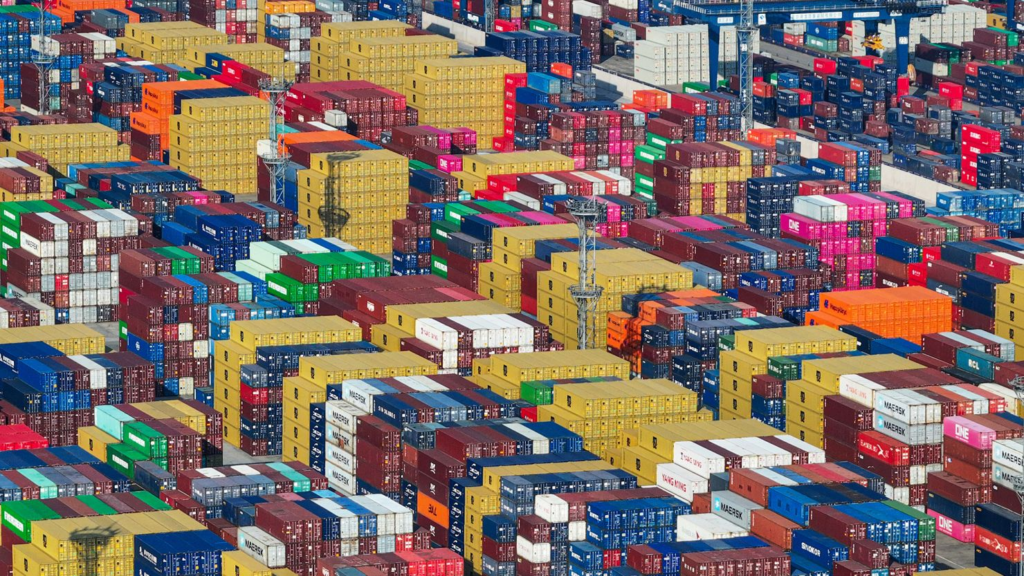

Global supply chains are gradually stabilizing as trade routes reopen and fewer goods face delays due to restrictions or tariffs. Companies that rely on cross-border logistics, such as FedEx and Maersk, have reported improved shipment flows and reduced costs.

Economists say the trickle-down effect from the U.S.-China thaw could add as much as 0.5% to global GDP in 2025. That’s a big shift from last year, when many predicted a synchronized global slowdown.

Explore global trade news and forecasts

Political Influence: Biden Administration’s Strategic Shift

Experts believe the Biden administration’s softer approach to China trade policy has played a major role in this turnaround. Rather than pushing for broad tariffs, the White House has focused on strategic competition and cooperation in key areas such as climate tech, AI regulation, and rare earth minerals.

The administration has also avoided escalating rhetoric, choosing instead to engage through diplomatic and economic channels. These choices have lowered market uncertainty and increased confidence in the direction of U.S. foreign trade policy.

White House officials have yet to confirm any major agreements, but internal sources suggest ongoing trade dialogues are constructive.

More on U.S. trade policy from the White House

Business Leaders React: Opportunity and Optimism

Corporate leaders are welcoming the reduced recession odds. CEOs from tech, manufacturing, and retail sectors say they are more comfortable making long-term investment decisions now that recession risk appears to be easing.

Tesla’s recent announcement to expand its supply network in Asia is one such example. Meanwhile, Apple, which has long been caught in the middle of U.S.-China tensions, is reportedly planning to increase production capacity in both countries.

Small businesses, too, may benefit. With reduced cost pressures and a potentially stronger dollar, imports may become cheaper—lowering prices for retailers and consumers alike.

Check how businesses are responding to economic shifts

Final Word: A Turning Point for 2025?

The dramatic reduction in Apollo’s recession forecast is more than just a number—it signals a shift in economic momentum and geopolitical strategy. While risks remain, including inflation, energy prices, and geopolitical tensions in other regions, the improving U.S.-China trade relationship is a major bright spot.

For businesses, investors, and everyday Americans, this change brings a sense of relief and a new reason for cautious optimism in 2025.

Also Read – Tense Times: U.S. Banks Brace as UK Holds Rates