In today’s global economy, tariffs are becoming a major obstacle for American businesses. From manufacturing and agriculture to retail and tech, many US companies are reporting serious challenges due to rising tariffs on imported goods and materials.

These trade barriers, often introduced as part of international disputes or political strategies, are causing higher costs, disrupted supply chains, and reduced competitiveness for U.S. businesses in both domestic and global markets.

In this article, we’ll break down the tariffs problem for US companies, the industries most affected, and what could be done to ease the burden.

What Are Tariffs and Why Do They Matter?

A tariff is a tax imposed by one country on goods imported from another. The goal is often to:

- Protect local industries

- Encourage domestic production

- Raise government revenue

- Retaliate in trade disputes

But while tariffs can offer short-term protection for certain sectors, they often lead to long-term pain for others, especially companies that rely on imported materials or global supply chains.

Tariffs Under Recent US Administrations

Over the past decade, tariffs have played a growing role in U.S. trade policy, especially with countries like China, the European Union, and Mexico. Some key developments include:

- 2018–2019: Tariffs imposed on steel, aluminum, and Chinese goods under the Trump administration

- 2020–2023: Retaliatory tariffs from trading partners and new restrictions during the COVID-19 crisis

- 2024–2025: Continued trade tensions and calls for stronger “Buy American” policies

While some industries were shielded from foreign competition, many others saw their operating costs skyrocket.

Who’s Feeling the Tariff Pressure?

Here are the industries most affected by the tariffs problem for US companies:

1. Manufacturing

Companies that build cars, machines, and electronics rely on imported metals, chips, and parts. Tariffs on steel, aluminum, and electronic components have:

- Increased production costs

- Delayed assembly timelines

- Reduced profit margins

Auto manufacturers, in particular, have been forced to raise prices or delay launches of new models.

2. Agriculture

American farmers have been hit hard by retaliatory tariffs from countries like China and India. Key exports such as soybeans, corn, and pork have dropped in demand, leading to:

- Oversupply and price crashes

- Lost global market share

- Increased reliance on government subsidies

3. Retail and Consumer Goods

Many popular products sold in the U.S.—from clothing and toys to electronics—are assembled or manufactured overseas. Tariffs have:

- Raised costs for importers

- Forced brands to increase prices for customers

- Squeezed small retailers operating on thin margins

Real Stories: Businesses Speak Out

Several American companies have voiced concerns publicly. For example:

- A Wisconsin tool manufacturer said that tariffs on Chinese steel increased raw material costs by 25%, forcing them to lay off workers.

- A California tech startup delayed its product launch because of high tariffs on imported circuit boards.

- A Texas furniture brand had to reduce product lines after wood and textile tariffs drove costs above profitable levels.

These are not isolated cases. A recent survey by the National Federation of Independent Business (NFIB) found that 38% of small businesses have been negatively impacted by tariffs in the last two years.

How Tariffs Affect Consumers Too

It’s not just companies feeling the heat. Tariffs often lead to higher prices for everyday items, as businesses pass increased costs to customers. For example:

- Electronics like smartphones and laptops became 5–10% more expensive

- Clothing and footwear saw moderate price hikes

- Kitchen appliances and tools faced limited availability due to import delays

In some cases, tariffs also reduce product variety, as companies cut options to keep costs down.

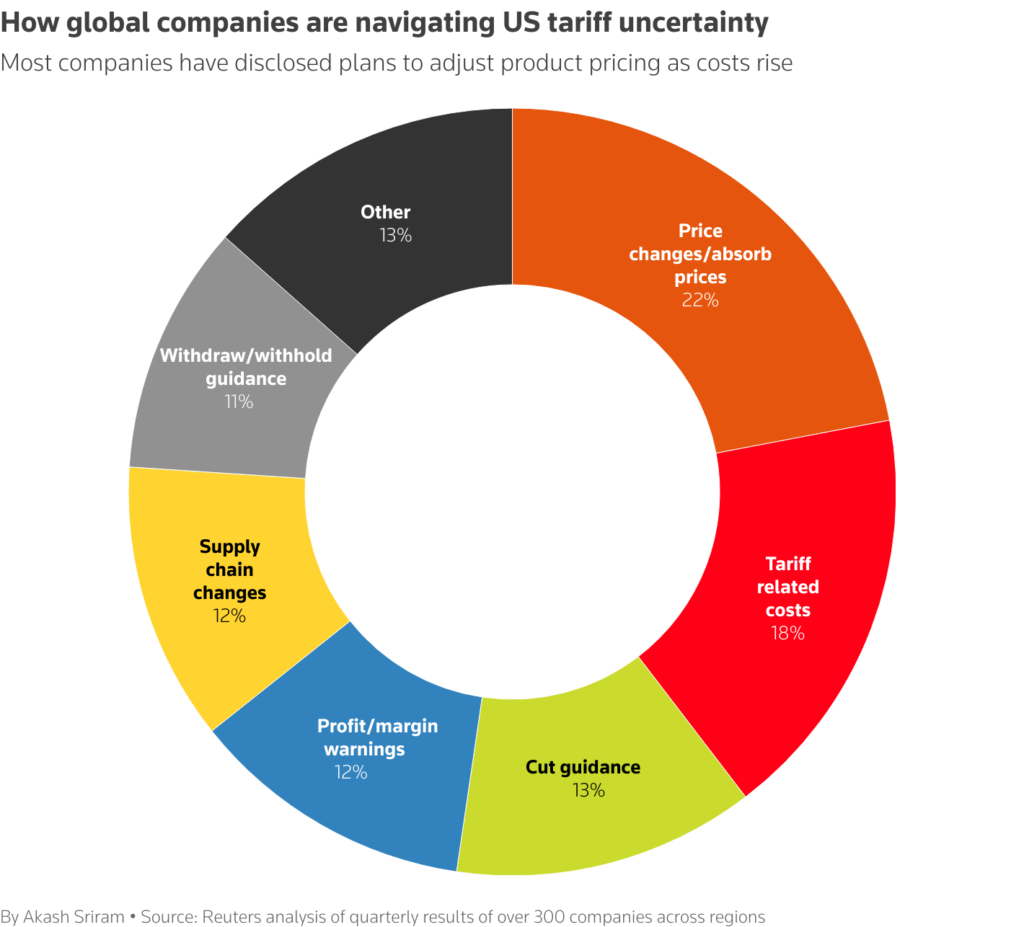

Can Companies Avoid Tariffs?

Some businesses try to work around tariffs by:

- Relocating supply chains to countries not affected by U.S. tariffs

- Negotiating bulk pricing with suppliers

- Absorbing costs to remain competitive

- Appealing for tariff exemptions through government programs

But for many small to mid-sized firms, these strategies are costly and complicated.

Economic and Political Impacts

The broader effects of the tariffs problem for US companies include:

- Slower business investment due to uncertainty

- Tense diplomatic relations with key trade partners

- Increased lobbying from industry groups seeking relief

- Supply chain shifts to countries like Vietnam, Mexico, or India

Some economists argue that excessive use of tariffs may isolate the U.S. from global trade networks, reducing innovation and long-term competitiveness.

What Can Be Done?

Experts suggest several solutions to ease the tariff burden:

- Negotiating trade deals that reduce or eliminate tariffs with allies

- Targeted relief programs for industries most affected

- Improved transparency in tariff policy to help companies plan better

- Incentives for domestic production to reduce import dependency

Business leaders are also calling for a more predictable, long-term trade policy that balances protection and open-market access.

Conclusion: A Complex Problem Needing Balanced Solutions

The tariffs problem for US companies is a complex issue with wide-ranging effects. While some industries benefit from trade protection, many others suffer from higher costs, lost sales, and global uncertainty.

As the U.S. navigates future trade relationships, policymakers and business leaders must work together to find balanced solutions—ones that protect domestic interests without stifling growth or innovation.

Also Read – U.S. Lifts Tariffs on Air Travel Routes—Massive Win for Aviation Growth