Despite recording strong profits this year, major banks across the globe are sounding the alarm over a growing recession risk due to inflation. Executives and analysts alike have highlighted that while the financial sector remains resilient, the broader economy is showing cracks, with inflationary pressures putting a strain on consumers, businesses, and policymakers alike.

In recent earnings calls and economic reports, several banking giants have maintained a cautious tone, estimating a 40% chance of a recession in the next 12 to 18 months if inflation continues to remain high. This article dives into why banks are still making money, what’s behind their warnings, and what this means for everyday people and the global economy.

Understanding Why Banks Are Still Profitable

Even as fears of a downturn rise, banks have continued to report impressive earnings in 2024 and 2025. Here are a few reasons why:

1. High Interest Rates = Bigger Margins

One of the main reasons banks remain profitable is higher interest rates. Central banks like the Federal Reserve, the European Central Bank, and others have raised interest rates in recent years to fight inflation. When interest rates go up, banks earn more money from loans, mortgages, and credit cards.

For example, if a bank lends money at 7% but only pays 2% on customer deposits, it earns a 5% spread. These net interest margins have improved significantly, boosting revenue across the board.

2. Strong Loan Demand (For Now)

Despite rising rates, loan demand remains strong in many sectors. Businesses are still borrowing for expansion, and consumers continue to take out loans for homes, cars, and education. This steady activity has helped maintain the flow of income for banks.

3. Diversified Services

Modern banks don’t just rely on lending. They earn from investment banking, wealth management, trading, insurance, and fees. While some segments slow down during tough times, others — like wealth advisory or risk management — stay stable or even grow.

Why Banks Are Warning About a Recession

So if banks are doing well, why are they worried? The answer lies in the future — not just the present.

1. Inflation Remains Stubborn

While inflation has slowed down from the record highs of 2022–2023, it’s still higher than central banks want it to be. Core inflation — which excludes food and energy — remains sticky, driven by factors like rising wages, high rent, and energy costs.

This is forcing central banks to keep interest rates high, which could eventually choke off spending and investment — leading to an economic slowdown or even a recession due to inflation.

2. Consumers Are Feeling the Pinch

Household budgets are under pressure. Credit card delinquencies, auto loan defaults, and mortgage late payments are slowly rising. According to a recent report from the U.S. Federal Reserve, consumer debt service ratios have reached their highest levels since 2008.

As people struggle to keep up with payments, banks could face more non-performing loans, which would hurt their future profits and stability.

3. Business Investments Are Slowing

Many businesses are pausing or delaying expansion plans due to uncertain economic conditions and high borrowing costs. This slowdown in business activity is a classic warning sign of an approaching recession.

4. Global Factors Add Pressure

Economic uncertainty is not limited to one country. Global conflicts, supply chain disruptions, climate-related events, and geopolitical instability (such as the ongoing Russia-Ukraine war and rising tensions in Asia) are all adding to the risk.

What a 40% Recession Risk Means

Several bank CEOs, including those at JPMorgan Chase, Citigroup, and Deutsche Bank, estimate that there is a 30% to 40% chance of a recession within the next year. This doesn’t mean a recession is guaranteed — but it’s a high enough probability that both consumers and businesses should prepare.

Here’s what a potential recession might look like:

- Job losses in vulnerable sectors like retail, construction, and manufacturing.

- Slower wage growth or wage freezes.

- Lower business profits, resulting in layoffs or reduced investment.

- Reduced consumer spending, especially on non-essential goods and services.

- Increased financial stress for lower-income households.

How Central Banks Are Responding

Central banks face a delicate balancing act. Their main tools are:

- Raising or lowering interest rates

- Quantitative tightening or easing (buying/selling government bonds)

- Forward guidance (communicating future intentions to the market)

So far, the approach has been cautious. Most central banks are keeping rates steady while watching inflation data closely. However, if inflation rises again or stays sticky, they may be forced to raise rates further — increasing the recession risk due to inflation.

On the other hand, if signs of a slowdown increase rapidly, they might cut rates to stimulate growth. But doing so too early could allow inflation to rebound. It’s a tightrope walk.

What It Means for You: Consumers and Small Businesses

For Consumers:

- Save more and borrow less — try to reduce credit card balances and avoid new high-interest loans.

- Build an emergency fund — ideally 3–6 months’ worth of expenses.

- Watch your spending — focus on essentials and cut back on luxuries.

- Be cautious with big purchases — buying a home, car, or new appliance should be carefully planned.

For Small Businesses:

- Review your debt — can you refinance or reduce interest payments?

- Hold off on expansion — wait until conditions are more stable.

- Focus on cash flow — ensure you have enough liquidity to manage slow months.

- Diversify your customer base — reduce dependency on one or two clients.

How Banks Are Preparing Themselves

Even while making profits, banks are preparing for the worst. Many are:

- Setting aside more reserves for bad loans.

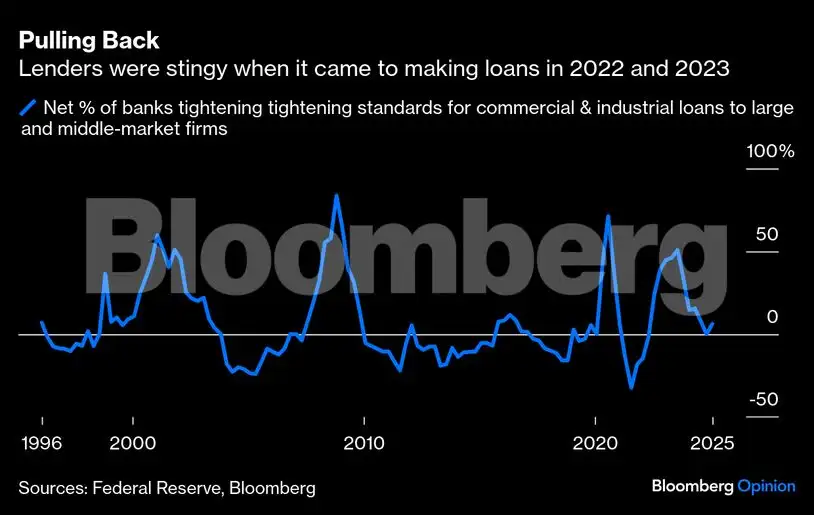

- Tightening lending standards to reduce future defaults.

- Investing in technology to lower operating costs.

- Reducing exposure to high-risk sectors like commercial real estate.

This kind of planning helps banks stay stable — but it also makes it harder for consumers and businesses to get loans.

Is There Any Good News?

Yes. A few silver linings are worth noting:

- Unemployment is still relatively low in many countries.

- Wages are rising, helping some consumers keep up with inflation.

- Supply chains are improving, reducing cost pressures.

- Housing markets are stabilizing in some areas, especially where prices had soared.

Economists say that if inflation cools off without a spike in unemployment or a collapse in demand, the economy could achieve a “soft landing” — a slowdown without a full-blown recession.

Final Thoughts

While banks remain profitable, their warnings about a recession risk due to inflation should not be ignored. A 40% chance may not sound like a certainty, but in economic terms, it’s a flashing yellow light.

For individuals, businesses, and policymakers, the best strategy is to stay cautious, reduce risk, and remain flexible. Inflation may not cause a crash overnight, but its ongoing pressure could slowly grind down economic activity if left unchecked.

Read Next – Tariff-Driven Customer Caution Slows CapEx and Hiring