The changing U.S. labour market has become one of the most important topics in today’s economy. After years of strong recovery from the pandemic, signs of cooling are becoming clear. Labour force participation remains below pre-pandemic levels, job growth is slowing, and both inflation and rising household debt are reshaping the financial realities of workers and families.

The labour market reflects much more than employment figures. It influences wages, consumer confidence, business investments, and the overall economic outlook of the country. Understanding the shifts in participation, job creation, inflation, and debt provides insight into where the U.S. economy may be heading.

Labour Force Participation: A Shifting Landscape

Labour force participation, which measures the share of working-age people who are either employed or actively seeking work, is a central indicator of economic health.

Post-Pandemic Trends

Before the pandemic, the participation rate was about 63 percent. The crisis forced millions to leave the workforce, and while many have returned, the rate has not fully recovered. Today it sits slightly lower than pre-pandemic levels, especially among older adults and women.

Why Participation Matters

Higher participation means more people are contributing to the economy, paying taxes, and building productivity. Lower participation, on the other hand, reduces the available talent pool, slows economic growth, and places greater strain on social safety programs.

Factors Behind the Decline

Several reasons explain this shift:

- Early retirements taken during the pandemic.

- A growing preference for part-time or gig work.

- High childcare costs preventing some parents from returning to work.

- Health issues, including long COVID, keeping some out of the labour force.

These realities suggest that the labour market is undergoing structural changes rather than just temporary adjustments.

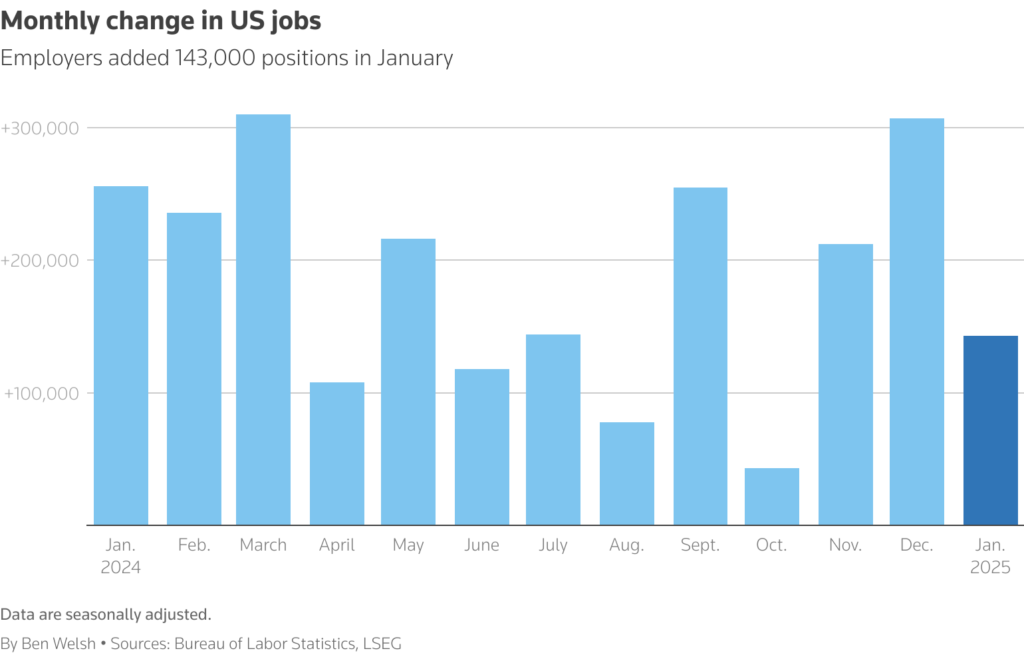

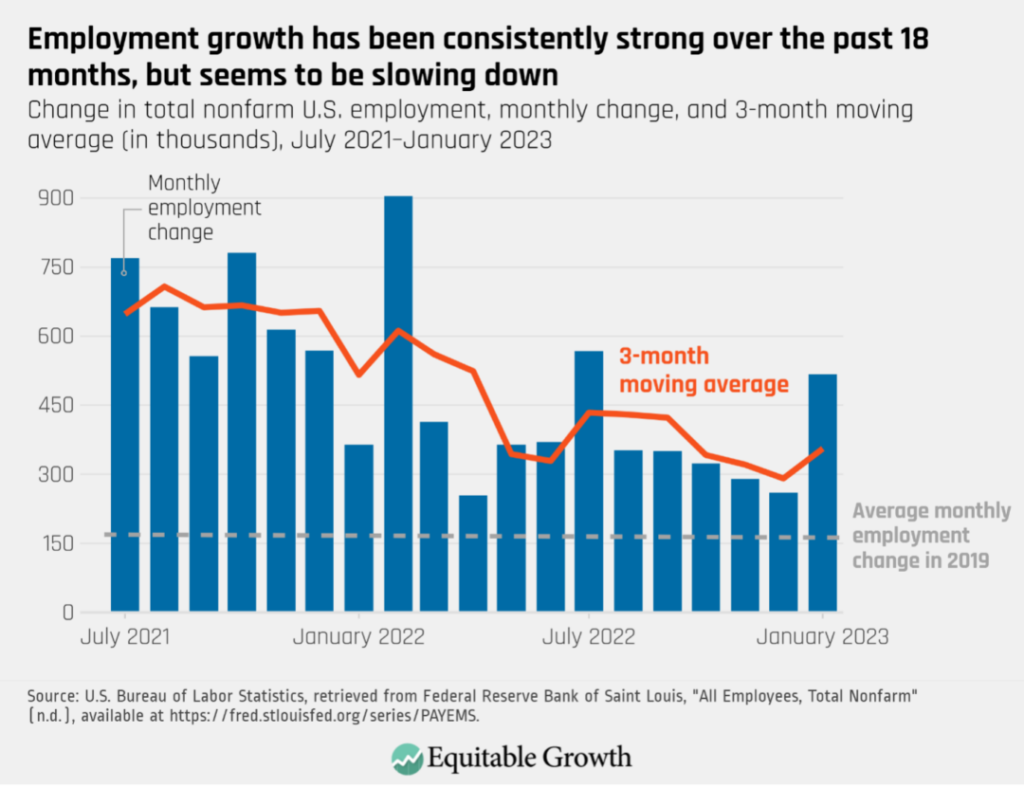

Job Growth Cooling

During the immediate post-pandemic recovery, job growth was strong, with businesses reopening and millions of jobs being created. Now, however, the pace of hiring is slowing.

Industries Facing Pressure

- Technology and finance have seen waves of layoffs after years of expansion.

- Retail and hospitality are stabilizing but no longer adding jobs at the same rapid rate.

- Healthcare and education remain steady but are hampered by staffing shortages.

Impact on Workers

For employees, cooling job growth means fewer opportunities and weaker bargaining power. While unemployment remains relatively low, the slower pace of hiring raises questions about future stability. Wage growth may also lose momentum, particularly if businesses feel pressure from rising costs and higher interest rates.

Inflation’s Impact on Workers

Inflation has become one of the most pressing issues in the economy. For workers, the question is no longer just about having a job, but whether wages can keep up with rising living costs.

Effects on Households

- Rising prices reduce the purchasing power of wages.

- Families spend a larger share of income on essentials like housing, food, and energy.

- Workers push for higher pay to cover rising expenses, leading to tense wage negotiations.

Monetary Policy Response

The Federal Reserve has raised interest rates in an effort to slow inflation. This policy brings its own effects: borrowing becomes more expensive, businesses may reduce hiring, and households face higher mortgage, credit card, and loan payments.

Inflation therefore influences the labour market in two ways: it cuts directly into household budgets while also shaping the decisions businesses and consumers make in the broader economy.

Rising Household Debt

Another factor weighing on workers is the record level of household debt. Mortgages, student loans, car payments, and credit card balances have all reached historic highs.

Debt and Worker Wellbeing

- A greater share of income goes toward loan repayments, limiting savings and spending.

- Financial stress can impact productivity and mental health.

- Younger workers burdened with student loans often delay major life decisions such as buying a home or starting a family.

The Connection to the Labour Market

When households carry heavy debt loads, consumer spending slows, and that spending is a major driver of U.S. job creation. At the same time, workers under financial pressure may feel forced to stay in jobs that are unsatisfying simply to keep up with payments.

Structural Shifts in Work

Beyond participation, hiring, inflation, and debt, the U.S. labour market is experiencing longer-term structural shifts that will continue to shape the future of work.

Remote and Hybrid Work

Remote and hybrid work arrangements, accelerated by the pandemic, remain popular across many industries. This trend has reshaped office demand, influenced housing choices, and changed how workers balance personal and professional lives.

Automation and Technology

Advances in artificial intelligence, robotics, and digital tools are changing the types of jobs available. While some roles are disappearing, others are being created, requiring new skills and adaptability from workers.

Demographic Challenges

An aging population means more retirements, fewer young workers, and greater demand for healthcare-related roles. Immigration policies will also play a significant role in determining the size and flexibility of the future workforce.

Policy Debates and Responses

The changing U.S. labour market has sparked intense policy debates.

- Expanding childcare support could help more parents enter the workforce.

- Immigration reform may ease labour shortages.

- Investment in education and retraining programs is essential to prepare workers for jobs in emerging industries.

- Balancing monetary policy to control inflation without sharply reducing employment remains a challenge.

Policymakers must consider both short-term pressures and long-term structural shifts when designing responses.

The Road Ahead

The U.S. labour market is at a turning point. If inflation continues to decline and interest rates stabilize, job growth may remain steady, though slower than before. Improvements in labour force participation could strengthen the economy further.

On the other hand, rising debt burdens and weaker job creation could create new obstacles for households and businesses alike. The future will likely demand a focus on adaptability, resilience, and equitable access to opportunities.

Conclusion

The changing U.S. labour market reveals both strengths and weaknesses in the economy. Participation rates remain below pre-pandemic levels, job growth is cooling, inflation is straining households, and debt burdens are rising. Meanwhile, structural changes like remote work, automation, and demographic shifts are redefining the nature of work itself.

How the country responds to these challenges will shape not just the economy but the daily lives of millions of workers. Ensuring a strong, adaptable, and inclusive labour market is essential for long-term prosperity.

Do Follow USA Glory On Instagram

Read Next – Healthcare Access and Affordability: The Ongoing Challenge