Anti-ESG political backlash has taken center stage in American politics and finance. Over the past few years, environmental, social, and governance (ESG) investing gained popularity as a responsible way for large firms to consider broader societal impacts in their investment strategies. However, this trend is now facing strong resistance from conservative political leaders and critics who believe ESG efforts are more about pushing a political agenda than securing strong financial returns.

In particular, financial giants like BlackRock and Vanguard—who manage trillions of dollars—are now under fire. Many lawmakers and state officials are accusing these companies of prioritizing climate and social goals over shareholder interests. The anti-ESG political backlash is not just a war of words; it is shaping policies, contracts, and the future of finance.

What Is ESG Investing?

ESG investing means that companies and investors consider environmental, social, and governance factors alongside financial metrics when making decisions. For example:

- Environmental: Carbon emissions, renewable energy, water use

- Social: Human rights, labor practices, community involvement

- Governance: Board diversity, transparency, executive pay

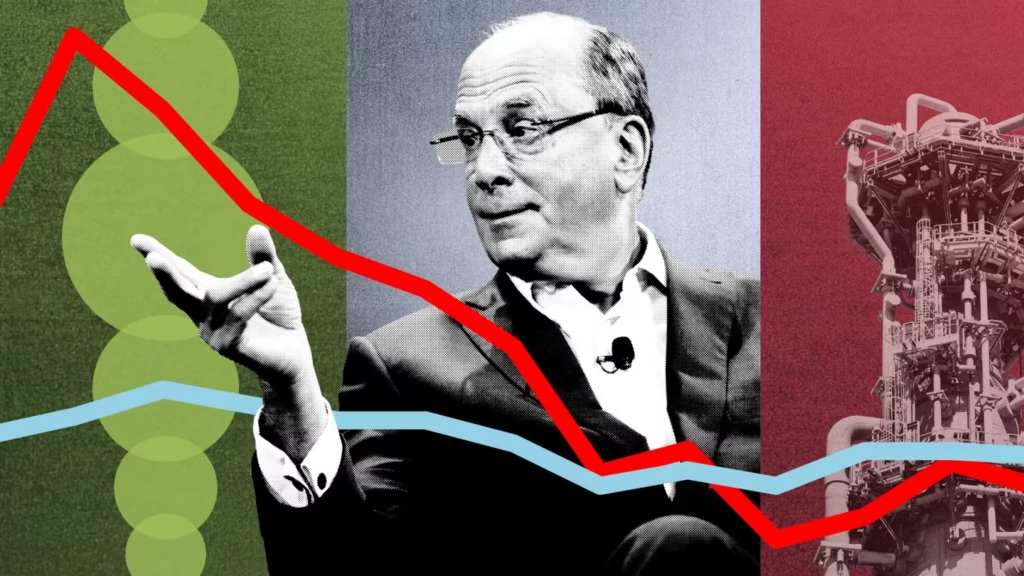

Firms like BlackRock, the world’s largest asset manager, have been vocal supporters of ESG strategies. CEO Larry Fink has consistently advocated for “stakeholder capitalism,” saying businesses must serve not just shareholders, but also employees, communities, and the planet.

Why the Anti-ESG Political Backlash?

Opponents of ESG claim that financial companies are overstepping their role by trying to influence social and political issues. The anti-ESG political backlash argues that:

- ESG investing can hurt financial performance.

- ESG promotes “woke capitalism” over free-market principles.

- ESG undermines the fossil fuel industry and traditional energy jobs.

- Firms like BlackRock use client funds to support liberal agendas.

Several Republican-led states have acted on this view. For example:

- Texas banned financial firms from doing business with the state if they “boycott” the oil and gas industry.

- Florida pulled $2 billion from BlackRock’s funds.

- West Virginia blocked BlackRock and five other firms from state banking contracts.

BlackRock and Vanguard’s ESG Strategy

BlackRock and Vanguard are not just typical investors; they are institutional giants managing retirement funds, pensions, and assets on behalf of millions of Americans. Their embrace of ESG investing includes:

- Supporting climate disclosure rules for companies.

- Pressuring corporations to have diverse boards.

- Voting in favor of shareholder proposals related to sustainability and human rights.

Despite the backlash, both firms insist that ESG is not about politics—it’s about long-term risk management. Climate change, for instance, poses serious risks to many industries and ignoring it could lead to massive financial losses.

Larry Fink has stated, “We focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients.”

Legal and Legislative Pressure

The anti-ESG political backlash is also gaining momentum in statehouses and courts. Some key developments include:

- State Treasurers from over a dozen Republican-led states forming alliances to oppose ESG.

- Proposed legislation in Congress to limit ESG factors in pension funds.

- Ongoing investigations into potential antitrust violations by ESG alliances like Climate Action 100+.

These actions suggest a deepening conflict between state governments and financial institutions, with legal consequences for ESG-related policies.

Public Opinion and Corporate Responsibility

Public views on ESG are mixed:

- Younger investors and millennials strongly support ESG, believing businesses should address climate change and social issues.

- Older and more conservative investors often prioritize returns over social impact.

This divide puts firms like BlackRock and Vanguard in a tough position. On one side, they risk alienating clients and governments if they stick with ESG. On the other, if they retreat from ESG, they face criticism from activist investors, younger demographics, and international stakeholders.

How Finance Firms Are Responding

The backlash has forced many asset managers to adjust their messaging, even if their strategies haven’t changed much. Key responses include:

- Reducing public emphasis on ESG in marketing materials.

- Clarifying investment strategies to avoid misunderstandings.

- Some firms have left ESG alliances like Net Zero Asset Managers due to pressure.

Vanguard, for instance, exited a major climate-focused alliance in 2022, citing the need to maintain independence and focus on delivering long-term value to investors.

Impact on the Investment Industry

The anti-ESG movement is reshaping how firms operate:

- Risk Disclosure: Companies are being cautious about how they report ESG metrics to avoid political backlash.

- Client Segmentation: Firms are tailoring portfolios based on political geography. What works in California may not fly in Texas.

- Consultant Services: A rise in firms offering “anti-ESG” investment strategies or “freedom investing”, which avoids companies seen as “woke.”

There is also a growing space for neutral investing, where the focus is purely financial performance without considering ESG or anti-ESG ideologies.

International Perspective

Interestingly, while the anti-ESG wave is surging in the U.S., Europe and other parts of the world are moving in the opposite direction:

- European Union has implemented stricter ESG regulations.

- Investors in Asia and Australia are demanding sustainability reports.

- Global financial institutions are forming stronger ESG frameworks.

This creates a complex landscape where U.S.-based firms must balance domestic politics with global expectations.

The Road Ahead: Compromise or Conflict?

Will ESG fade away under pressure? Unlikely. But it may evolve.

- ESG could become more data-driven and transparent, focusing on measurable risks rather than ideology.

- Firms may adopt a more customizable approach for clients—offering ESG, non-ESG, and anti-ESG options.

- Policymakers might push for neutral legislation, where ESG decisions are allowed but not mandated.

At its core, the debate is about who gets to decide what’s best for investors: Wall Street, Main Street, or the government?

Conclusion

The anti-ESG political backlash is one of the most significant shifts in the world of finance today. BlackRock and Vanguard, as industry leaders, find themselves at the heart of this storm. While the backlash is intense, it also reflects deeper questions about the role of business in society, the future of capitalism, and how we balance profit with purpose.

As both sides dig in, investors, politicians, and companies must prepare for a new era—one where financial decisions are no longer just about dollars and cents, but also about values, politics, and long-term survival.

Read Next – Berkshire Hathaway Bank Stock Sell-Off Raises Concerns