What Is Buy Now, Pay Later?

Consumers seek flexibility and convenience in their shopping experiences. Enter Buy Now, Pay Later (BNPL)—a financial model that allows shoppers to purchase items immediately and pay for them over time. This approach has gained significant traction, offering an alternative to traditional credit cards.

One of the leading companies in this space is Affirm, which has revolutionized the BNPL landscape by providing transparent, fee-free payment solutions. Founded in 2012 by Max Levchin, a co-founder of PayPal, Affirm aims to empower consumers with honest financial products that improve lives.

How Affirm Works: A Simple Breakdown

Affirm’s BNPL service is designed to be user-friendly and transparent. Here’s how it works:

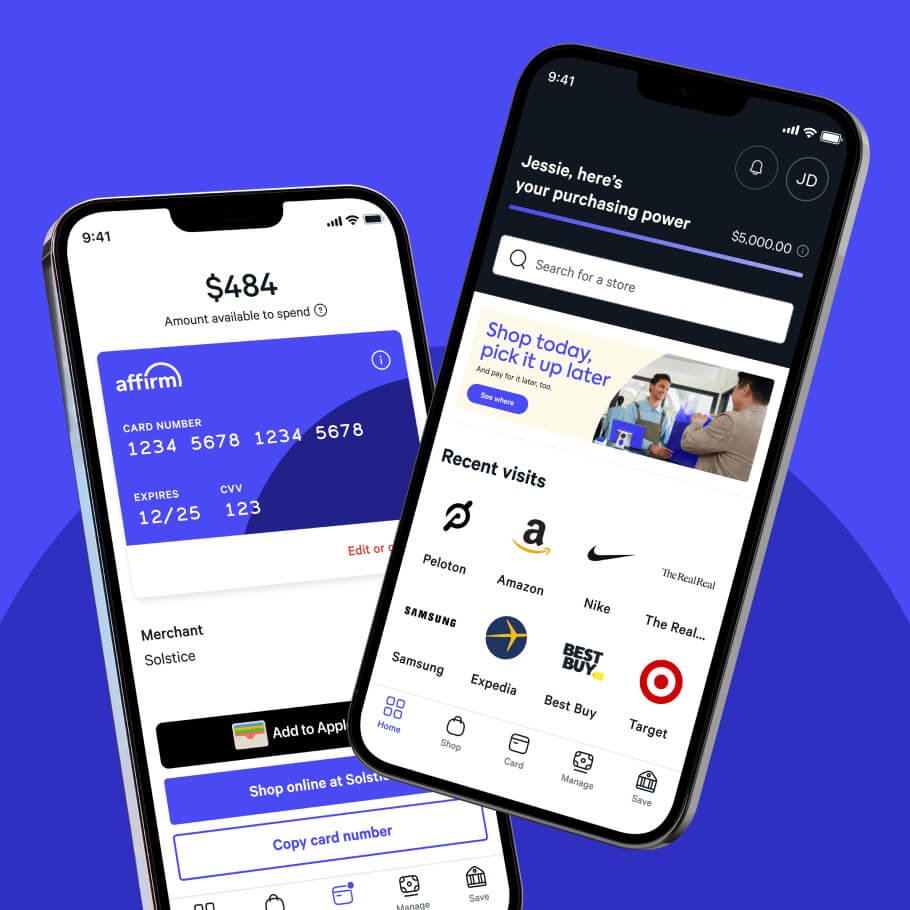

- Shop Online or In-Store: When you’re ready to make a purchase, select Affirm as your payment method at checkout.

- Choose Your Payment Plan: Affirm offers various payment plans, ranging from biweekly to monthly installments, depending on the purchase amount and retailer.

- Instant Approval Decision: Affirm uses a soft credit check and other factors to determine eligibility, providing an immediate decision without affecting your credit score.

- Make Payments: Once approved, you can make payments through Affirm’s app or website, with no hidden fees or late charges.

Affirm’s commitment to transparency means you’ll know exactly how much you’ll pay upfront, with no surprises down the line.

Affirm’s Business Model: How Does It Make Money?

Affirm generates revenue through several channels:

- Merchant Fees: Affirm partners with retailers, charging them a percentage of each sale facilitated through its platform. This fee typically ranges between 4% and 6%.

- Interest on Loans: For certain payment plans, Affirm charges simple interest to consumers. The annual percentage rates (APRs) vary based on factors like creditworthiness and purchase amount.

- Interchange Fees: When consumers use Affirm’s virtual card for purchases, the company earns a portion of the interchange fees from the transaction.

By diversifying its revenue streams, Affirm maintains a sustainable business model while offering consumers flexible payment options.

The Rise of BNPL: Why Consumers Love It

The BNPL model has gained popularity for several reasons:

- Financial Flexibility: Consumers can spread out payments over time, making larger purchases more manageable.

- Transparency: Unlike traditional credit cards, BNPL services like Affirm provide clear terms with no hidden fees.

- Accessibility: BNPL options are often available to consumers with varying credit histories, broadening access to financing.

These benefits have resonated with a wide range of consumers, particularly younger demographics seeking alternatives to traditional credit.

Affirm’s Impact on Retailers

Retailers partnering with Affirm have reported several advantages:

- Increased Sales: Offering BNPL options can lead to higher conversion rates and average order values.

- Customer Acquisition: Flexible payment options attract new customers who might have been hesitant to make a purchase upfront.

- Enhanced Loyalty: Providing convenient financing solutions can improve customer satisfaction and repeat business.

Affirm’s partnerships with major retailers like Amazon and Shopify underscore its value proposition in the e-commerce space.

Challenges and Considerations

While BNPL services offer numerous benefits, there are considerations to keep in mind:

- Consumer Debt: There’s a risk that consumers may overextend themselves by taking on multiple BNPL plans simultaneously.

- Regulatory Scrutiny: As BNPL services grow, they may face increased regulation to ensure consumer protection.

- Economic Factors: Economic downturns can impact consumers’ ability to repay loans, affecting BNPL providers’ financial stability.

Affirm addresses these challenges by employing rigorous underwriting processes and emphasizing responsible lending practices.

The Future of BNPL and Affirm

The BNPL industry is poised for continued growth, with Affirm at the forefront of this financial revolution. The company is expanding its services internationally, including recent launches in the UK. Additionally, Affirm is investing in new technologies and partnerships to enhance its offerings and reach more consumers.

As consumers increasingly seek flexible and transparent payment options, BNPL services like Affirm are well-positioned to meet these demands. By prioritizing honesty, simplicity, and innovation, Affirm continues to reshape the shopping experience for millions worldwide.

Also Read – Robinhood: Transforming Online Brokerage with Innovative Features