The Court’s Ruling: A Blow to Trump’s Trade Agenda

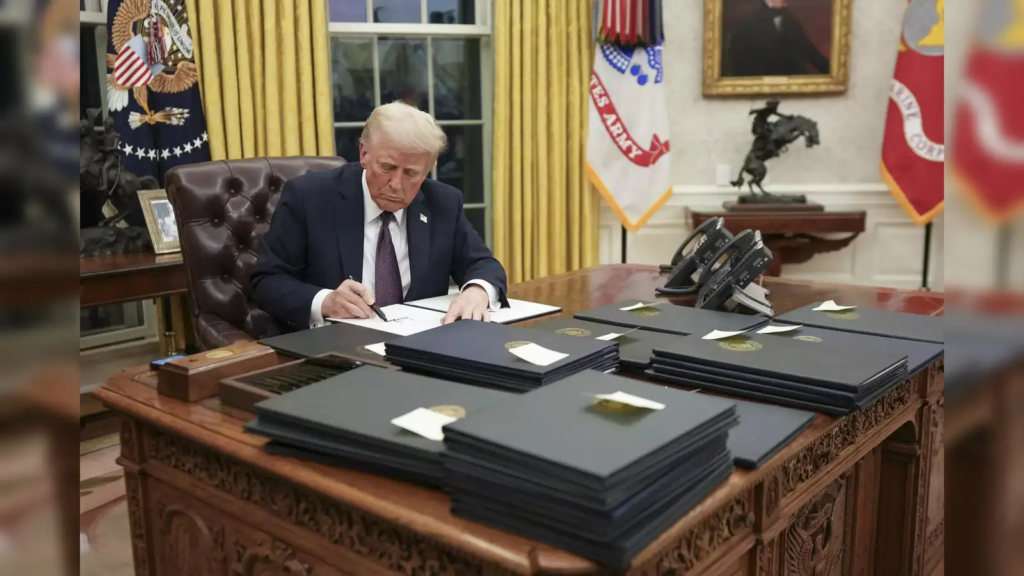

On Wednesday, May 28, 2025, the U.S. Court of International Trade delivered a sharp rebuke to President Trump’s trade strategy, Tariffs ruling that his use of the IEEPA to impose across-the-board tariffs on imports from countries with trade surpluses was unconstitutional. The court emphasized that the U.S. Constitution grants Congress exclusive authority to regulate international commerce, a power that cannot be overridden by the president’s emergency declarations. The tariffs, dubbed “Liberation Day” tariffs by Trump, included a baseline 10% levy on most nations, with higher rates—up to 145% on Chinese imports—targeting countries like China, Mexico, and Canada.

The court’s decision came in response to lawsuits filed by a coalition of 12 U.S. states, led by Democratic attorneys general, and five small businesses. Oregon Attorney General Dan Rayfield, whose office spearheaded the states’ lawsuit, called the tariffs “unlawful, reckless, and economically devastating.” The judges, including one appointed by Trump himself, ruled that the IEEPA, a 1977 law intended for national emergencies, does not grant the president “unbounded authority” to impose tariffs at will. The court ordered the Trump administration to halt the tariffs within 10 days, though the administration promptly filed an appeal, questioning the court’s jurisdiction.

Market Reaction: Dollar and Stocks Soar

The financial markets wasted no time reacting to the news. The U.S. dollar, which had been under pressure due to trade uncertainties, rallied sharply against major currencies. It gained 0.64% against the Japanese yen, reaching 145.77, and 0.67% against the Swiss franc. The euro and British pound, meanwhile, saw declines as the dollar index climbed above 100. Wall Street futures also surged, with S&P 500 E-mini futures rising 1.5% and Nasdaq futures climbing 1.9%. Asian markets followed suit, with Japan’s Nikkei jumping 1.7% and South Korea’s Kospi gaining 1.2%.

Investors had been rattled by Trump’s tariff announcements earlier in the year, which triggered a market crash on April 9, 2025. The initial tariffs, including a 34% levy on Chinese imports and 25% on car imports, led to a $2.4 trillion loss in S&P 500 market value, the largest single-day drop since March 2020. The court’s decision to block these tariffs provided a much-needed reprieve, easing fears of inflation and economic slowdown.

Why Investors Are Relieved

Trump’s tariffs, announced in April 2025, were among the steepest trade barriers in over a century. They included a 10% baseline tariff on all imports, with higher rates for countries like China (145%), Vietnam (46%), and Japan (24%). The administration argued that these measures would address the U.S. trade deficit and protect American industries. However, critics, including economists and business leaders, warned that the tariffs would raise costs for consumers, disrupt global supply chains, and invite retaliation from trading partners.

What’s Next for Trade and the Dollar?

While the court’s decision is a win for free-trade advocates, it’s not the end of the story. The Trump administration’s appeal could escalate the case to the U.S. Court of Appeals for the Federal Circuit and potentially the Supreme Court. Legal experts believe the lawsuits have a strong chance of success, given the constitutional limits on presidential authority over trade. However, Trump may still pursue narrower, sector-specific tariffs, such as those on steel and aluminum, which were not affected by the ruling.

Broader Implications for the U.S. Economy

The court’s ruling has far-reaching implications beyond the dollar and stock markets. By curbing Trump’s ability to impose tariffs unilaterally, it reinforces congressional authority over trade policy, potentially reshaping how future administrations approach international commerce. For American consumers, the halt on tariffs could delay price increases on everyday goods, from groceries to electronics.While the court’s decision is a win for free-trade advocates, it’s not the end of the story. The Trump administration’s appeal could escalate the case to the U.S. Court of Appeals for the Federal Circuit and potentially the Supreme Court. Legal experts believe the lawsuits have a strong chance of success, given the constitutional limits on presidential authority over trade. However, Trump may still pursue narrower, sector-specific tariffs, such as those on steel and aluminum, which were not affected by the ruling.While the court’s decision is a win for free-trade advocates, it’s not the end of the story. The Trump administration’s appeal could escalate the case to the U.S. Court of Appeals for the Federal Circuit and potentially the Supreme Court. Legal experts believe the lawsuits have a strong chance of success, given the constitutional limits on presidential authority over trade. However, Trump may still pursue narrower, sector-specific tariffs, such as those on steel and aluminum, which were not affected by the ruling.

Conclusion

The U.S. dollar’s rally on May 29, 2025, reflects a collective sigh of relief from investors as a federal court blocked President Trump’s sweeping import tariffs. The decision has eased fears of a global trade war, boosted stock futures, and stabilized Treasury yields, offering a temporary reprieve from months of economic uncertainty.

Read More :- Social Media Platforms Test New Ad Formats, Prioritizing Short-Form Video Content in the USA