The U.S. payments industry is heading into 2025 with major changes on the fintech horizon. The federal government is introducing new regulations aimed at protecting consumers, increasing transparency, and reducing financial fraud. But while these rules may offer stronger oversight, many experts believe they could also slow down innovation in the fast-growing payments space.

This article looks at how new regulations will affect the U.S. payments sector in 2025, what fintech companies need to watch out for, and how consumers might benefit—or lose out.

The Push for Regulation in Fintech

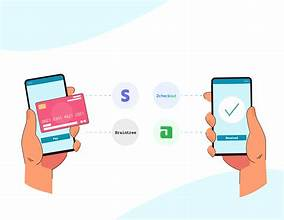

In the last decade, digital payments have exploded in popularity. Apps like Cash App, Venmo, Zelle, and Stripe have changed the way people send and receive money. The growth of cryptocurrency, digital wallets, and Buy Now Pay Later (BNPL) services has also introduced new challenges for regulators.

As a response, agencies like the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve are stepping in. In 2025, several new regulations are expected to take effect:

- Stronger Know Your Customer (KYC) rules

- Tighter control on digital wallets and crypto transactions

- Clearer disclosure requirements for BNPL services

- New licensing for payment processors and embedded finance platforms

According to the CFPB, these steps are designed to improve security and build trust in financial technology. But the cost of compliance could be heavy for startups and small fintechs.

Innovation vs. Compliance: A Tough Balance

For many fintech companies, the biggest challenge is balancing compliance with innovation. Regulations often bring more paperwork, longer approval times, and higher costs. This could lead to fewer new features, slower rollout of services, or even companies exiting the market.

“Regulation is necessary, but it must be smart regulation,” says Jonathan Marino, a fintech policy expert. “If we go too far, we risk losing the innovation edge that the U.S. has built over the years.”

Startups might struggle the most. Many don’t have the resources to hire legal teams or set up complex compliance systems. This could result in fewer new players entering the market, and less competition overall.

Related Reading:

What is Embedded Finance and Why It Matters in 2025

Impact on Consumers: More Protection, Less Speed

Consumers may see both pros and cons from the regulatory shift. On the positive side, users can expect stronger fraud protection, more transparency, and better control over personal data. BNPL services, for example, will now have to provide clearer repayment terms and interest disclosures.

But innovation might slow down. The days of lightning-fast fintech launches and endless new features could be over. Digital payment users may face more verification steps, longer wait times, or limited access to certain services, especially in crypto.

“Consumers will be safer, but they might lose some convenience,” says fintech consultant Sarah Nguyen. “It’s a trade-off between security and speed.”

Crypto and Digital Wallets Under the Microscope

The crypto market is one of the most affected areas. The government is looking to bring stablecoins, crypto exchanges, and decentralized finance (DeFi) platforms under more strict rules. These include:

- Mandatory registration with the SEC or CFTC

- Full customer verification for all crypto wallets

- Real-time monitoring and reporting of large transactions

This could reduce the number of scams and illegal activities, but it may also push some crypto activity offshore. Crypto companies that can’t or won’t comply might move their operations to countries with looser regulations.

More on This:

How the SEC Is Regulating Crypto in 2025

Payment Processors and Banks: Caught in the Middle

Traditional banks and payment processors are also in a tough spot. While they welcome more regulation to create a level playing field, they also worry about being overburdened. Many large firms have already begun updating their systems to meet new federal and state guidelines.

The Federal Reserve’s new FedNow system, which enables real-time payments between banks, is also being affected by new compliance requirements. Banks must now carry out more detailed identity checks, even for instant transfers.

This has created new opportunities for companies that offer regtech (regulatory technology) solutions. These firms help others automate compliance tasks using AI and machine learning.

Recommended Link:

What is RegTech? A Look at the Future of Compliance

Global Competition and Innovation Slowdown

One of the biggest fears is that too much regulation will make U.S. companies less competitive globally. Countries like Singapore, the UK, and Switzerland are actively supporting fintech innovation with flexible rules and government backing.

If U.S. companies fall behind, they could lose customers to international platforms offering smoother, faster, and cheaper services.

“The U.S. needs to strike the right balance,” says policy analyst David Lee. “We don’t want to kill innovation while trying to control it.”

Conclusion: A Pivotal Year Ahead

The year 2025 is shaping up to be a pivotal moment for the U.S. payments industry. While new regulations are expected to bring more order and safety to the sector, they also pose real risks to innovation and growth.

Fintech firms, traditional banks, and consumers must all prepare for a shift. Smart regulation can ensure the U.S. remains a global leader in digital payments, but only if it supports progress, not blocks it.

Also Read – America’s Bold Strategy to Win the AI and Tech War