Robinhood has emerged as a significant player in the financial services industry, democratizing access to trading and investment opportunities. Founded in 2013 by Vladimir Tenev and Baiju Bhatt, Robinhood’s mission is to provide everyone with access to the financial markets, not just the wealthy.

The Genesis of Robinhood

Before delving into Robinhood’s impact, it’s essential to understand its origins. Tenev and Bhatt, both Stanford University graduates, identified a gap in the brokerage industry: high fees and complex platforms deterred many from investing. They envisioned a platform that was free, easy to use, and accessible to all. This vision led to the birth of Robinhood.

Key Features of Robinhood

- Commission-Free Trading: Robinhood disrupted traditional brokerage models by offering commission-free trades for stocks, ETFs, options, and cryptocurrencies. This approach allowed users to execute trades without incurring standard brokerage fees, making investing more accessible.

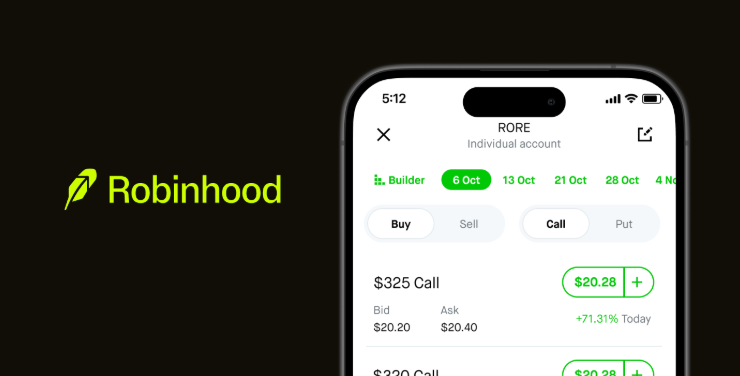

- User-Friendly Interface: The platform’s intuitive design caters to both novice and experienced investors. With a few taps, users can buy or sell securities, view real-time market data, and monitor their portfolios.

- Fractional Shares: Recognizing that high share prices could be a barrier, Robinhood introduced fractional shares, enabling users to invest in expensive stocks with as little as $1.

- Cash Management: Beyond trading, Robinhood offers cash management services, including a debit card and competitive interest rates on uninvested cash, providing users with more control over their funds.

- Cryptocurrency Trading: In 2018, Robinhood expanded into cryptocurrency trading, allowing users to buy, sell, and hold cryptocurrencies like Bitcoin and Ethereum alongside traditional assets.

Robinhood’s Business Model

Robinhood’s revenue model differs from traditional brokerages. The company primarily earns through:

- Payment for Order Flow (PFOF): Robinhood receives compensation for directing user orders to market makers for execution. While this practice has faced scrutiny, it’s a standard industry practice that allows platforms to offer commission-free trades.

- Interest on Cash Balances: The company earns interest on uninvested cash in user accounts, contributing to its net interest income.

- Robinhood Gold: This subscription service offers users access to premium features, including margin trading and professional research, for a monthly fee.

Financial Performance and Growth

Since its public debut in 2021, Robinhood’s stock (HOOD) has experienced significant volatility. The company’s financial performance is influenced by various factors, including market conditions, trading volumes, and regulatory developments.

Global Expansion

Initially serving U.S. customers, Robinhood has expanded its services internationally. In March 2024, the company launched in the United Kingdom, offering stock and margin trading. CEO Vlad Tenev expressed the company’s ambition to become the primary financial app for UK users.

Regulatory Challenges and Responses

Operating in the financial sector requires stringent adherence to regulations. Robinhood has faced several regulatory challenges, including:

- GameStop Trading Restrictions: In early 2021, amid the GameStop trading frenzy, Robinhood restricted trading for certain stocks, leading to congressional hearings and debates about market manipulation and platform responsibility.

- Regulatory Fines: The company has incurred fines for various compliance issues. For instance, in 2021, Robinhood agreed to a $70 million settlement with FINRA over allegations of misleading customers and failing to maintain adequate systems.

In response to these challenges, Robinhood has emphasized its commitment to regulatory compliance, enhancing its customer support infrastructure, and increasing transparency in its operations.

Innovations and Future Outlook

Robinhood continues to innovate, aiming to provide users with comprehensive financial services. In 2024, the company announced plans to introduce AI-powered financial advice, targeting investors seeking personalized financial planning. Additionally, Robinhood expanded into the Asia-Pacific market with a new office in Singapore, signaling its intent to capture a global audience.

Conclusion

Robinhood has undeniably transformed the financial landscape by making investing more accessible and affordable. While the company has faced challenges, its commitment to innovation and customer-centric services positions it well for future growth. As the financial industry continues to evolve, Robinhood’s role as a disruptor and innovator will likely remain significant.

Read Next – Toast, Inc.: Transforming Restaurant Management with Innovative Technology