In the current economic climate, the debate around tariffs is heating up again. As the U.S. government considers new trade tariffs, Democrats are sounding the alarm. They argue that tariffs are a hidden tax—one that directly impacts American families by increasing prices on everyday goods. While tariffs are often portrayed as a penalty on foreign countries, in reality, the costs often fall on consumers at home.

This article explores how tariffs function, why Democrats call them a hidden tax, and how these trade policies ripple through household budgets across the nation.

Understanding Tariffs and Their True Cost

Tariffs are taxes imposed by governments on imported goods. The goal is typically to protect domestic industries, reduce dependency on foreign products, or gain leverage in trade negotiations. However, the real-world outcome is more complicated.

Who Actually Pays Tariffs?

While the idea sounds simple—tax foreign goods so American companies can compete better—the cost is usually passed on to consumers. When a U.S. retailer imports a product from abroad and pays a tariff, they don’t just absorb that cost. Instead, they raise the price to maintain profit margins.

So, when you buy a pair of shoes, an appliance, or groceries that contain imported ingredients, you may be paying a portion of the tariff without even realizing it. That’s why many lawmakers and economists describe tariffs as a “hidden tax.”

Democrats’ Framing: Tariffs as Hidden Tax

Democratic leaders have been increasingly vocal about the real cost of tariffs, especially as the Biden administration considers new measures against Chinese imports. They warn that working-class and middle-income families are already struggling with inflation, and additional tariffs will only make life harder.

Statements from Prominent Democrats

Senator Elizabeth Warren has said, “Tariffs might sound tough, but they’re just a quiet tax on groceries, clothing, and other basics.” Similarly, Representative Alexandria Ocasio-Cortez warned that new tariffs “mean higher prices for working people, not billionaires.”

These concerns are not just political talking points. Multiple studies, including those by the Peterson Institute for International Economics, show that consumers shoulder more than 90% of the costs of tariffs.

Impact on Families: Real-World Examples

Let’s break down how this hidden tax plays out in real life:

1. Grocery Bills

Many food items are produced using imported ingredients—think coffee, fruits, seafood, and even packaging materials. A tariff on aluminum or agricultural imports causes price hikes at every step of the supply chain, eventually raising supermarket prices.

2. Clothing and Footwear

The fashion industry relies heavily on imports. When tariffs are applied to textiles or finished goods from countries like China or Vietnam, retailers adjust prices upward. The end result? Families pay more for school uniforms, winter coats, and everyday wear.

3. Electronics and Appliances

From smartphones to refrigerators, many modern gadgets contain components made abroad. Tariffs on these parts or on the final products increase costs that manufacturers and retailers pass on to consumers.

4. Construction and Housing

Tariffs on steel, lumber, or machinery lead to increased construction costs. This indirectly drives up rent and home prices, especially in areas already suffering from a housing shortage.

Hidden Tax vs. Transparent Taxation

Another reason why Democrats criticize tariffs is the lack of transparency. With regular taxes, you know what you’re paying and why. It appears on your paycheck, receipt, or tax return.

But tariffs are invisible to most people. There’s no label at the store that says, “This price includes a 25% tariff.” That hidden nature makes it harder for the public to understand how much they’re actually contributing to government revenue.

Are Tariffs Always Bad? A Balanced View

While the Democratic stance is largely critical, it’s important to understand that tariffs aren’t inherently harmful. Used wisely, they can be strategic tools to protect key industries or encourage fair trade. But they come with trade-offs.

Pros of Tariffs:

- Protect domestic industries from unfair foreign competition.

- Encourage local production, leading to more jobs in some sectors.

- Serve as a bargaining chip in international trade talks.

Cons of Tariffs:

- Increase costs for consumers.

- Strain international relationships.

- Invite retaliatory tariffs, which hurt U.S. exporters.

So the issue isn’t just whether tariffs are good or bad—it’s about how they’re used, and who they affect the most.

Political Divide: How Republicans and Democrats Differ

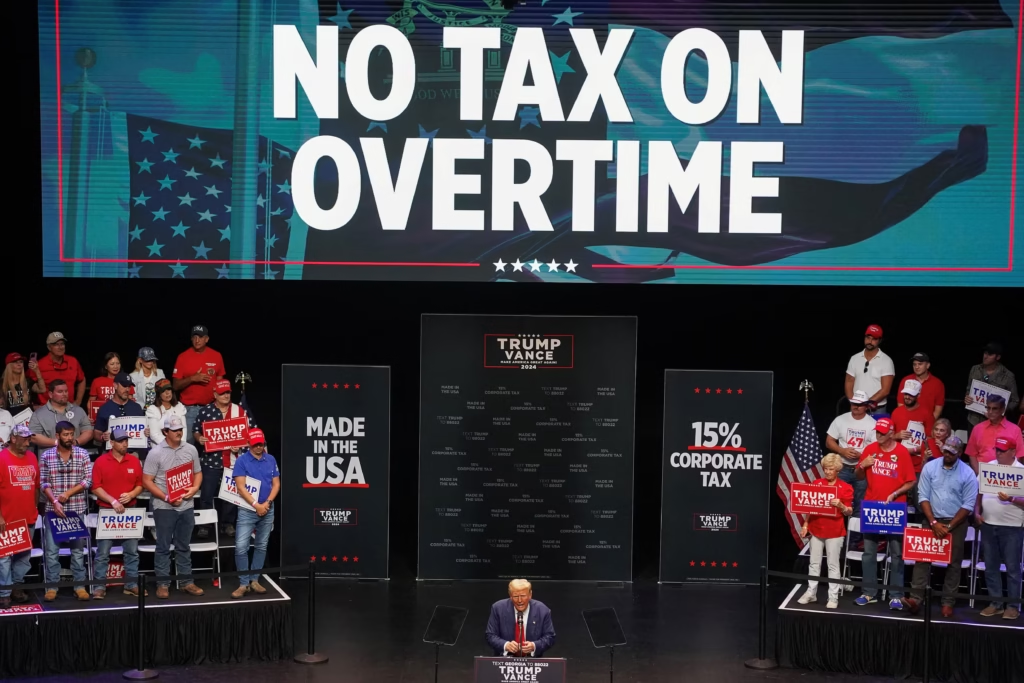

Republicans generally argue that tariffs help balance trade and strengthen American industries. Former President Donald Trump made tariffs a central part of his “America First” policy, placing heavy levies on Chinese goods and even suggesting tariffs on allies like Canada and the EU.

Democrats, on the other hand, caution that this approach is short-sighted. They argue that the U.S. should prioritize diplomacy, innovation, and domestic investment over punitive tariffs. They frame tariffs as a hidden tax because they believe the burden unfairly falls on regular families—not corporations or wealthy elites.

How Families Can Prepare and Respond

While individuals can’t control trade policy, there are ways to lessen the blow:

- Buy local when possible: Local goods are less likely to be affected by international tariffs.

- Look for sales and discounts: Retailers may try to offset price hikes with promotions.

- Follow tariff news: Being informed helps you anticipate price changes.

- Use budgeting apps: Tracking expenses helps adjust to rising costs.

Economic Experts Weigh In

Many economists agree with the Democrats’ concerns. A 2023 study from the Tax Foundation found that proposed tariffs on Chinese electronics could cost the average American household an additional $350–$500 per year. That may not seem huge, but for low-income families, it adds significant pressure.

In addition, the Congressional Budget Office reported that the tariffs enacted from 2018–2020 reduced U.S. GDP growth by 0.3% annually. In other words, tariffs might protect some jobs, but they slow down the economy as a whole.

Are There Alternatives to Tariffs?

If tariffs are such a problematic “hidden tax,” what are the alternatives?

Democrats and some economists suggest the following:

- Invest in domestic manufacturing through subsidies and tax breaks.

- Strengthen supply chains with allies instead of relying heavily on adversarial nations.

- Use targeted sanctions instead of broad tariffs to influence international behavior.

- Negotiate multilateral trade agreements that ensure fair play while minimizing costs to consumers.

Conclusion: Transparency Matters in Trade Policy

Tariffs may seem like a smart solution on paper—punish foreign companies and boost American jobs. But when the hidden costs trickle down to the dinner table, the story changes. Democrats call tariffs a hidden tax because they often raise the cost of living for everyday Americans while disguising that increase as something else.

In an era where inflation is already a concern, it’s more important than ever for trade policies to be transparent, strategic, and fair. Families deserve to know when they’re paying more—and why.

Do Follow On Instagram.

Read Next – ESG Investment Volatility Under Trump—Policy Changes Ripple Through Social Values