TikTok Buzz Highlights Investor Concerns Over Tariff Uncertainty

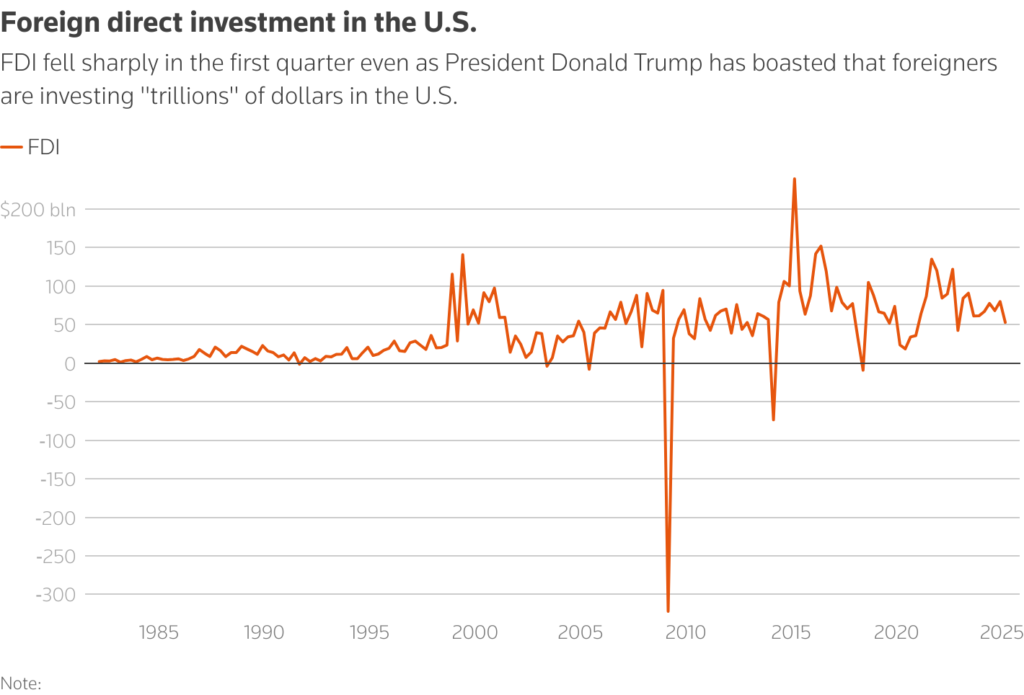

The United States saw a sharp drop in foreign direct investment (FDI) during the first quarter of the year, raising fresh concerns among business leaders, economists, and even creators on TikTok. The dip is being largely attributed to ongoing trade tensions, tariff uncertainty, and political shifts ahead of the upcoming U.S. elections.

According to newly released data from the U.S. Department of Commerce, FDI inflows fell by over 30% compared to the same period last year, signaling that international investors are growing cautious about placing money in U.S. ventures.

TikTok Reacts to FDI Decline and Trade Tensions

While economic reports are typically discussed in boardrooms, the topic of foreign direct investment and tariffs has surprisingly entered the TikTok space. Young investors, finance influencers, and global business students are using short-form content to break down what this FDI drop really means.

One video with over 700,000 views explains how uncertainty around future U.S. trade policies is causing hesitation among global investors. “Why would a company in Germany or Japan open a new plant in the U.S.,” the creator asks, “when tariffs might suddenly change in six months?”

The power of TikTok to explain economic trends to a broader audience is playing a major role in keeping public discourse active and accessible—even on complex topics like FDI and international trade.

1. Tariff Uncertainty Discourages Global Investment

At the heart of the issue is the uncertainty around U.S. tariffs, especially with rising tensions between the U.S. and China, Europe, and even Canada. Foreign companies are now unsure how long current trade rules will remain, or whether they’ll face new taxes on imports, exports, or manufacturing operations.

With such unpredictability, many businesses are holding back on major investment decisions until policy clarity improves.

2. Political Risk Ahead of 2024 Elections

The upcoming U.S. presidential election has made investors more cautious. Different parties have opposing trade agendas, and global companies are wary of sudden shifts in regulations, trade deals, or economic policy.

This kind of political risk often causes a slowdown in long-term financial commitments—especially for foreign corporations considering large-scale operations, acquisitions, or partnerships in the U.S.

3. Interest Rate Uncertainty Adds to Investor Caution

Another reason for the drop in FDI is the Federal Reserve’s stance on interest rates. While some signs of economic recovery exist, inflation concerns have kept interest rates relatively high. For foreign investors, higher rates can reduce the profitability of U.S.-based projects, especially in sectors like real estate, manufacturing, and tech.

Additionally, capital is now flowing to emerging markets with better risk-reward ratios, further pulling money away from the U.S.

4. Rise of “Friendshoring” and Regional Diversification

Many countries are now turning to “friendshoring”—the idea of relocating investments to politically stable or allied countries. Instead of placing all bets on U.S. soil, investors are diversifying across regions like Southeast Asia, Eastern Europe, and Latin America.

TikTok users have been discussing this trend, often comparing how countries like Vietnam, India, and Mexico are attracting investments once headed for the U.S.

5. Tech and Energy Sectors Still See Some Growth

Despite the overall decline, there are exceptions. The clean energy and tech sectors still attracted moderate investment. With Biden’s push for renewable energy and infrastructure development, some foreign companies are still entering U.S. markets—but at a slower and more selective pace.

Startups in AI, battery storage, and sustainable logistics continue to attract venture capital and tech-driven FDI, though the momentum is not enough to offset the overall downturn.

What This Means for the U.S. Economy

FDI plays a major role in the U.S. economy by:

- Creating jobs

- Boosting innovation

- Strengthening trade relationships

- Expanding regional development

A significant drop in foreign direct investment could slow growth, reduce tax revenue, and put pressure on industries that rely on global capital—such as construction, healthcare, and retail.

This isn’t just a Wall Street problem. Cities and towns across the U.S. could see fewer new factories, offices, and projects—directly affecting local jobs and wages.

How Business Leaders Can Respond

To rebuild trust among global investors, business leaders and policymakers must:

- Push for stable trade policies

- Provide clear guidance on tariffs

- Create investment-friendly tax frameworks

- Build stronger international partnerships

Meanwhile, platforms like TikTok can help by spreading awareness and keeping younger audiences engaged in economic conversations. The more people understand the “why” behind the numbers, the more informed action they can take.

Conclusion: A Wake-Up Call in a Shifting World

The sharp fall in U.S. foreign direct investment is a warning sign that global trust in the American economic environment is wavering. Tariff uncertainty, political instability, and changing investor behavior are all playing a role.