The U.S. economy in 2025 is showing signs of a remarkable recovery, bringing hope to businesses, workers, and families across the nation. After a turbulent start to the year marked by trade tensions and economic uncertainty, recent developments suggest the country is on a path to steady growth. From cooling inflation to major trade deals and renewed consumer confidence, the economy is bouncing back in ways that are both surprising and encouraging. Let’s dive into what’s driving this turnaround and what it means for everyday Americans.

A Temporary Trade Truce Sparks Optimism

One of the biggest catalysts for the economic rebound is the recent U.S.-China trade agreement. Earlier this month, the two global powerhouses agreed to slash steep tariffs for 90 days, hitting the brakes on a trade war that had threatened to derail global growth. This deal has already had a ripple effect. Stock markets surged, and major brokerages like Goldman Sachs and Barclays scaled back their U.S. recession forecasts, with Goldman cutting its odds to 35% from 45%.

The trade truce has given businesses breathing room. Retailers, who were bracing for higher costs due to tariffs, can now plan for the back-to-school season without the immediate threat of skyrocketing prices. For consumers, this means more affordable goods, from clothing to electronics, at least for the next few months. Economists are cautiously optimistic, noting that while the deal is temporary, it’s a step toward stabilizing trade relations. Nationwide Chief Economist Kathy Bostjancic upgraded her 2025 growth forecast, predicting the economy could expand by up to a full percentage point by year-end.

Inflation Cools, but Challenges Loom

Inflation, a persistent concern for Americans, is finally showing signs of retreat. In April 2025, the Consumer Price Index (CPI) reported an annual inflation rate of 2.3%, the lowest since February 2021. Prices for everyday items like groceries, gasoline, and clothing dropped from March to April, offering relief to households. This slowdown is a win for the Federal Reserve, which has been working to keep inflation near its 2% target.

However, experts warn that inflation could creep up again. President Donald Trump’s tariffs, while temporarily eased, are expected to push prices higher starting in May or June. According to a Yale Budget Lab report, current tariff policies could cost the average U.S. household an extra $2,800 in the short term. Economists like Mark Zandi from Moody’s predict that the May CPI report will reflect the first signs of tariff-driven price hikes. For now, though, Americans are enjoying a rare moment of price stability, which is boosting spending and confidence.

Consumer Spending Fuels Growth

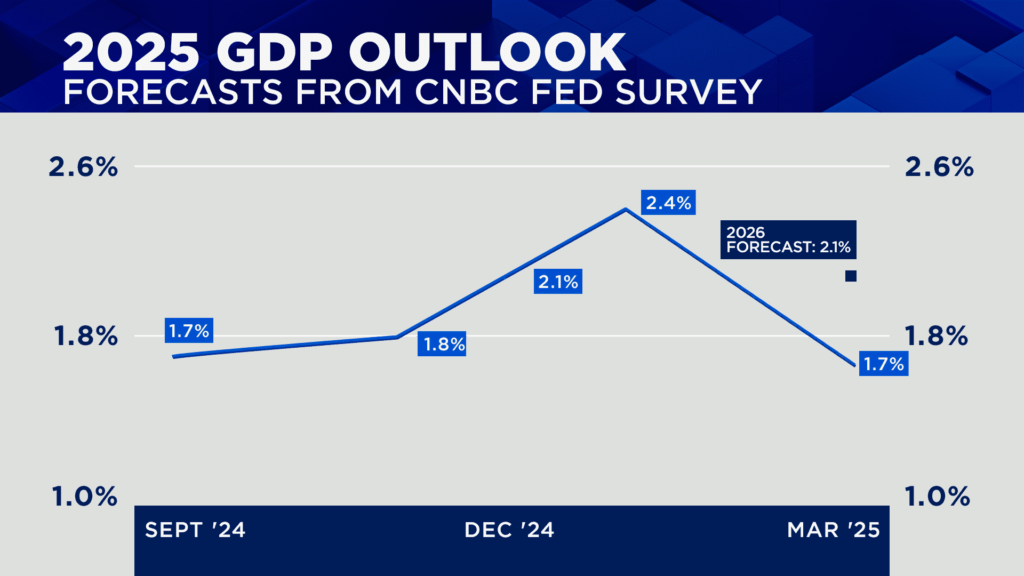

Despite earlier fears of a recession, American consumers are opening their wallets again. Consumer spending, a key driver of the economy, rose in the first quarter of 2025, even as GDP dipped slightly by 0.3%. This resilience is a testament to the strength of the U.S. labor market. Unemployment remains low at 4.2%, and job growth, while cooling, still added 152,000 jobs per month on average. With steady incomes and lower inflation, people are feeling more comfortable spending on everything from dining out to big-ticket items like cars.

The housing market is also showing signs of life. After years of high interest rates and unaffordable homes, lower inflation has prompted the Federal Reserve to signal potential rate cuts in 2025 and 2026. This could make mortgages more accessible, encouraging first-time buyers to enter the market. For families who postponed major life decisions like buying a home or starting a family due to economic anxiety, these changes offer a glimmer of hope.

Big Investments Boost the Economy

Another bright spot is the influx of foreign investment. A $600 billion commitment from Saudi Arabia, announced during President Trump’s recent trip to the Gulf, is set to pour into U.S. industries like technology, manufacturing, and energy. This deal, coupled with the lifting of sanctions on Syria, signals a broader push to strengthen international partnerships. These investments are expected to create jobs and spur innovation, particularly in regions hit hard by economic slowdowns.

Small businesses, often called the backbone of the economy, are also benefiting. With trade tensions easing, supply chains are stabilizing, allowing entrepreneurs to restock inventory and plan for growth. In cities like Miami and Houston, where ports are bustling again, local economies are seeing a surge in activity. Business owners who were once hesitant to expand are now hiring and investing in new equipment, confident that the worst of the uncertainty is behind them.

Challenges and Uncertainty Ahead

While the outlook is brighter, it’s not all smooth sailing. The temporary nature of the U.S.-China trade deal means negotiations will be critical in the coming months. If talks falter, tariffs could snap back, reigniting inflation and disrupting supply chains. Additionally, some Americans remain wary. A Harris poll conducted in late April found that 64% of independents believe the economy is worsening, and many are holding off on major purchases or life changes due to uncertainty.

Policy shifts also pose risks. Trump’s trade policies, while softened for now, have created a “whipsaw” effect, making it hard for businesses to plan long-term. The Federal Reserve, led by Chair Jerome Powell, is walking a tightrope, balancing the need to control inflation with the risk of slowing growth too much. Economists expect just two rate cuts this year, a sign that the Fed is proceeding cautiously.

What This Means for You

For everyday Americans, the economic rebound is a mixed bag. Lower inflation and stronger job prospects are reasons to celebrate, but the threat of rising prices looms large. Families can take advantage of current price drops to stock up on essentials or make long-delayed purchases. Small business owners should seize the moment to invest in growth, while keeping an eye on trade developments. And for investors, the stock market’s recent rally offers opportunities, though caution is warranted given the uncertainty.

The U.S. economy in 2025 is like a runner catching their second wind. After a rocky start, it’s picking up speed, fueled by smart trade moves, consumer resilience, and big investments. But the race isn’t over, and hurdles remain. By staying informed and adaptable, Americans can navigate this evolving landscape and come out stronger.

Looking Forward

As the year progresses, all eyes will be on the U.S.-China trade talks and the Federal Reserve’s next moves. If the trade truce holds and inflation stays in check, 2025 could mark a turning point for the economy. For now, the signs are promising, and the U.S. is proving it has the grit to bounce back. Whether you’re a worker, a business owner, or just someone trying to make ends meet, this is a moment to stay engaged and optimistic about what’s ahead.