As we move deeper into 2025, economic analysts worldwide are closely watching key indicators that suggest a potential slowdown in global and national economies. Some forecasts even warn of a possible recession in the latter half of this year. This growing concern is prompting businesses, investors, and governments to prepare for uncertain times ahead.

What Are Economic Forecasts Saying?

Economic forecasts are predictions based on various data points such as employment rates, inflation, consumer spending, and industrial production. In recent months, many experts have signaled warning signs that economic growth may slow down considerably. This slowdown could be severe enough to trigger a recession—a period marked by a decline in economic activity lasting for several months or more.

A recession generally means reduced consumer spending, higher unemployment rates, and lower business profits. Several factors are contributing to this gloomy outlook, including persistent inflation, tightening monetary policies, global geopolitical tensions, and supply chain disruptions.

Inflation and Monetary Policy: A Key Concern

One of the main reasons analysts are cautious is the persistent inflation that many countries continue to face. Inflation refers to the general rise in prices of goods and services over time. When inflation is high, the purchasing power of consumers decreases, leading to less spending.

Central banks, including the U.S. Federal Reserve and the European Central Bank, have responded by increasing interest rates to try and control inflation. However, higher interest rates can also slow down economic growth because borrowing becomes more expensive for both businesses and consumers.

For example, higher mortgage rates can reduce home buying, and increased loan costs can lead businesses to delay investments or expansions. These effects can accumulate, causing a broader economic slowdown.

Supply Chain and Global Tensions Impact

Global supply chains have still not fully recovered from disruptions caused by the COVID-19 pandemic and recent geopolitical conflicts. Ongoing challenges in sourcing raw materials and components are increasing costs for manufacturers. This situation contributes to inflation and creates uncertainty for businesses trying to plan for the future.

Additionally, geopolitical tensions between major economies continue to create instability. Trade restrictions, tariffs, and diplomatic conflicts add further pressure on global markets, slowing down trade and investment.

What Does a Recession Mean for Ordinary People?

If the predicted recession occurs in late 2025, it could affect everyday life in several ways:

- Job Security: Companies may slow hiring or lay off workers to reduce costs.

- Spending Power: Inflation and stagnant wages could limit how much people spend on goods and services.

- Investment Returns: Stock markets often react negatively during recessions, impacting retirement funds and investments.

- Credit Availability: Banks may tighten lending, making it harder to get loans or credit cards.

Despite these challenges, recessions also bring opportunities for savvy investors and entrepreneurs. Economic downturns often lead to innovation, business restructuring, and new market trends.

Governments and Businesses Preparing for the Slowdown

Governments around the world are actively monitoring economic data and adjusting fiscal policies to soften the impact of a potential recession. Some are increasing spending on infrastructure projects to boost employment, while others are offering support to vulnerable sectors such as small businesses.

Businesses, on their part, are focusing on improving efficiency, cutting unnecessary expenses, and diversifying supply chains to reduce risks. Many companies are also investing in technology to automate processes and reduce long-term costs.

What Experts Are Saying

Several respected economists have recently shared their outlooks on the economy:

- According to a recent report by the International Monetary Fund (IMF), global growth is expected to slow in 2025, with some advanced economies potentially entering recession territory.

- Financial expert Dr. Jane Roberts from the Economic Policy Institute stated, “While a recession is not guaranteed, the warning signs are strong enough that businesses and consumers should prepare for tougher times.”

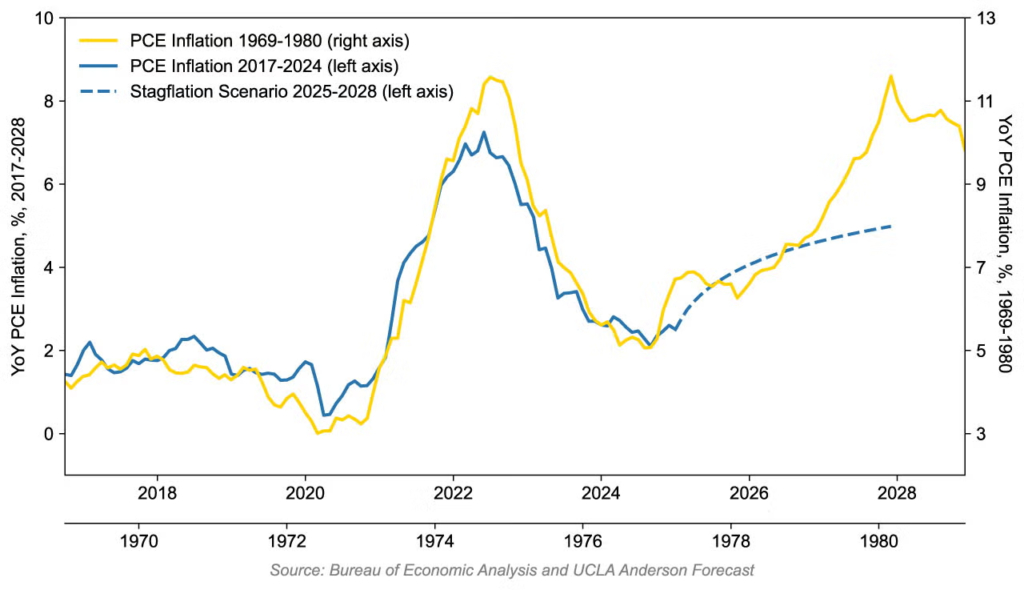

- A leading bank’s quarterly forecast highlighted the risk of “stagflation,” a situation where slow growth and high inflation occur simultaneously, which could pose a major policy challenge.

How Can Individuals Prepare?

If you are concerned about the economic outlook, there are several practical steps you can take to protect yourself financially:

- Build Emergency Savings: Having at least 3-6 months’ worth of expenses saved can provide a safety net during uncertain times.

- Reduce Debt: Paying down high-interest debt can help free up money and reduce financial stress.

- Diversify Income: Consider side jobs or freelance work to supplement your main income.

- Invest Wisely: Avoid panic selling investments and focus on long-term goals.

- Stay Informed: Keep up to date with reliable economic news sources like Bloomberg or Reuters.

Looking Ahead: Is Recession Inevitable?

While some forecasts predict a recession in the latter half of 2025, it is important to remember that economic predictions are not certainties. Economies are complex and influenced by many factors, some of which can change unexpectedly.

Government interventions, technological advancements, or improvements in global trade could help prevent or soften a recession. Likewise, strong consumer confidence and spending might sustain growth longer than expected.

Conclusion

Economic forecasts for 2025 indicate caution, with increasing risks of a slowdown or even recession in the latter half of the year. Inflation, high interest rates, supply chain challenges, and geopolitical tensions are key factors contributing to this outlook. While this scenario presents challenges for businesses, investors, and individuals alike, being informed and prepared can help mitigate risks.

Stay alert to economic news and consider financial planning strategies to navigate this uncertain period with confidence.

Also Read – U.S. Stock Market Surges After Surprising Jobs Report